What Is the Dax Index?

Date Modified: 31/01/2024

The DAX (short for the Deutscher Aktien Index), is an index that currently includes the largest 40 blue-chip companies trading on the Frankfurt Stock Exchange (the FWB) and is sponsored by the Deutsche Börse Group. The FWB is the largest of Germany’s seven stock exchanges, and the 12th largest stock exchange in the world. On active trading days, the market is open from 09:00 to 17:30 CET. As of the third quarter of 2021, the DAX was expanded to include 40 companies.

The DAX was founded in 1988, and the base value of the index at that time was 1,163. The performance of the DAX is a representative reflection of the Frankfurt Stock Exchange’s overall status in real-time. Until the introduction of the DAX, there was no standard index of German stocks. Instead, there were several independent listings run by banks or media outlets.

The index has since gained popularity and is now one of the most traded indices in the world, alongside the FTSE (UK 100), the Dow Jones Industrial Average- DJIA (USA30-Wall Street), and other similar indices.

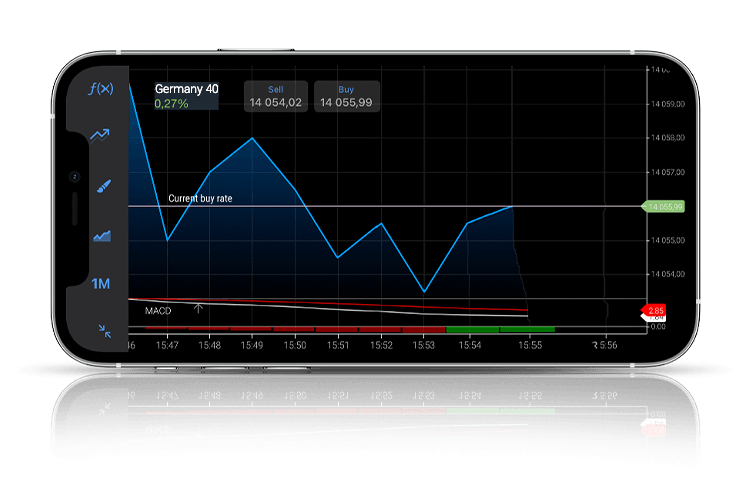

Illustrative prices.

How is the DAX calculated?

The DAX is calculated by free-floating market capitalisation. This means that only shares that are available for trading are counted towards each company’s market cap. The Deutsche Börse Group has operated the low-latency, fully electronic Xetra trading venue to determine DAX pricing since 2006. Xetra has used the T7 trading architecture since 2017 to provide the stability and availability required to run Germany’s largest cash market. Xetra is operated by the Frankfurt Stock Exchange and includes 200 trading participants from 16 European countries, as well as Hong Kong, and the United Arab Emirates.

The Xetra system calculates the DAX price every second, making the index extremely accurate. The calculation is weighted by using only the free-floating, or liquid, shares of the companies that are included in the index. This methodology means that any shares that are not available for purchase or sale in the market, such as those held by the company itself, are not counted.

Several of the member corporations are large and multinational and their performance is affected by Germany and the global economy. The index constituents now make up 80% of the market capitalisation of all publicly-traded German companies.

The Frankfurt Stock Exchange has created two versions of the DAX, a performance index and a price index. The performance index is most commonly quoted. However, the price index is the index that resembles commonly quoted indexes in other countries, such as the S&P 500 and the FTSE 100 (UK 100). In the DAX performance index, corporate distributions such as dividends, capital gains, and cash payments are calculated as part of the share price. In the DAX price index, these disbursements are not taken into account.

Can I trade the DAX as an instrument?

While you cannot trade the DAX directly on the Plus500 platform, you can trade CFD futures contracts that are based on the DAX index. You can open a buy position if you believe the DAX is heading up, or open a sell position if you feel the index will take a downturn. Another way to trade the DAX is through options trading. Traders can also place Buy/Sell orders on Options CFD (Call and Put).* Opening a position on the DAX also exposes you to potential losses if the trade goes against you.

Who is responsible for the DAX?

The DAX is operated by the Deutsche Börse Group, which organizes marketplaces for the trading of shares and securities, and also runs the Frankfurt Stock Exchange. The Deutsche Börse Group also runs an index for medium-sized German companies called the MDAX, as well as an index for smaller German companies called the SDAX.

*Instruments availability subject to regulation.

Learn More About Germany 40

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.