The History of Bitcoin

Date Modified: 2025/02/10

With a relatively short history, Satoshi Nakamoto, Blockchain, and Bitcoin have all become household names that push the limits of how we view global currencies.

Just as popular as its origins, Bitcoin has also become notorious for price swings that often make news headlines and grab the attention of financial traders. It has also led to the creation of other digital currencies such as Ethereum, and Litecoin. Bitcoin even has other cryptocurrencies created when nodes chose not to upgrade to the latest protocol, creating a new currency out of Bitcoin's old protocols, such as Bitcoin Cash ABC (BCHUSD).

TL;DR

- Origins: Launched in 2009 by Satoshi Nakamoto, Bitcoin introduced decentralised transactions via blockchain.

- Mining: Bitcoin mining rewards halve every 210,000 blocks, with a supply cap of 21 million coins.

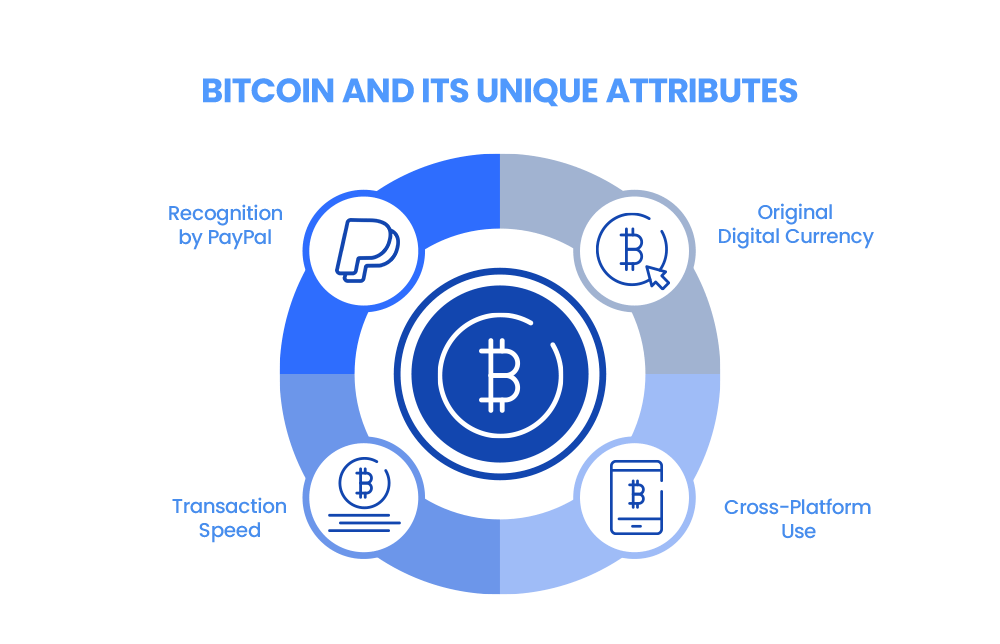

- Features: Bitcoin is widely usable, unlike network-specific coins, but its transactions take relatively longer to complete.

- Impact: As the largest cryptocurrency by volume, Bitcoin drives market trends and adoption, e.g., PayPal support.

What Coins Existed Before Bitcoin?

While it is true that Bitcoin is often deemed the father of cryptocurrencies as many consider it to be the first-ever cryptocurrency, there are many other coins that are considered its predecessor. Before Bitcoin, there were many attempts at creating cryptocurrencies like Blinded Cash, DigiCash, B-Money, Bit Gold, Hashcash, and more. Nevertheless, none of those attempts measure up to Bitcoin's success or leverage.

When and Why Was Bitcoin Created?

Bitcoin's creation marked, in effect, the first milestone in the crypto revolution when it was created in 2009 as the first decentralised currency to run on Blockchain technology. First mentioned in a white paper that was published by someone with the pen name Satoshi Nakamoto, Bitcoin promised the ability to conduct government-free transactions, relying on digital signatures and digital coins instead of on centralised government-issued fiat currencies like the euro and the US dollar among other Forex pairs. All transactions were kept on a ledger that can be publicly accessed, ensuring transparency.

Crypto miners, the individuals who volunteer their personal computing power to the network to keep it running, are paid in Bitcoin and have a say in new protocols that are adapted to the blockchain network. This allows them to work as a type of central bank, looking out for the best interest of the digital coin as a collective, similar to the role central banks like the ECB and FOMC have in determining the status of fiat currencies.

Bitcoin's decentralised and blockchain protocols require all nodes to verify a transaction. Since these computers are spread across the globe and run by various individuals, it is considered very difficult to hack or corrupt.

This is considered by some to be a secure system and has continuously captured public interest since its creation. Despite Bitcoin being well known amongst traders for its price swings, many believe that this leading digital currency is here to stay.

How Is Bitcoin Different From Other Cryptocurrencies?

While Bitcoin may be the original digital currency, others have been created since. Yet, Bitcoin has managed to remain unique in a number of ways and other cryptocurrencies are even referred to as Altcoins (alternative coins to Bitcoin).

Other cryptocurrencies have been developed since 2009 with the potential to manage digital economies like Ethereum. They focused on developing contracts and digital services that can be paid for using their own specific digital coins. For example, Axie Infinity (AXSUSD) is actually a native token and coin made for payment and operation on its own network and game, while Bitcoin can act as a fiat currency.

Bitcoin has remained a form of cross-platform currency. Without being limited to use on specific Bitcoin-only platforms, this cryptocurrency can be used to make purchases anywhere in the world where it is accepted. Furthermore, the main aim behind Bitcoin is to increase transaction speed without numerous government restrictions.

In 2020 Bitcoin made headlines when Paypal (PYPL) announced that this popular currency will be recognised as a payment on their platform.

Bitcoin Mining

Mining refers to the process of using high-powered computers to validate block transactions through solving complex mathematical equations.

There are mined and non-mined cryptocurrencies and Bitcoin is considered to be among the former. Bitcoin is powered by individuals who offer anywhere from individual computers to full server farms to keep the ledger active and verified.

In exchange, miners are given a predetermined amount of Bitcoin in return for the number of transactions they approve. As more Bitcoin is created, there are built-in 'Halving' events built into the protocol every time 210,000 blocks are processed.

It is called a halving event because the amount of Bitcoins a miner is awarded for processing a block decreases by half when passing these thresholds. Whereas other cryptocurrencies like Cardano (ADA), Solana (SOL), and Polkadot (DOT) are non-mineable, the purpose behind non-mineable and mineable cryptocurrencies is the same. Both types of cryptocurrencies aim to validate transactions, and eventually, each blockchain transaction needs to be verified one way or the other.

Bitcoin Verification and Block Time

Block time refers to the amount of time needed by miners to verify Bitcoin transactions in one block and produce a new block in the blockchain. The Bitcoin network requires all active nodes to be able to verify the same transaction and share its ledger with all other network users. This keeps the system transparent and harder to compromise.

While this is not unique to Bitcoin, it is something that other digital currencies have laxed their rules in order to reduce processing time.

One of Bitcoin's most significant downsides is the long verification time, which can take an average of 10 minutes. In comparison, the network of Ethereum, one of Bitcoin's biggest competitors, takes approximately 13 seconds.

How Many Bitcoins Are There?

Bitcoin has a maximum amount of 21 million coins that can be mined or created. This limit of 21 million coins is called a hard cap, encoded in its source code and enforced by the nodes on the network. Once it reaches this limit, no more Bitcoins can be created and miners will be able to collect transaction fees for their work in mining Bitcoin.

In comparison, Ethereum (ETHBTC) has no limit on how many coins can be mined.

While there are differences between each type of cryptocurrency, Bitcoin remains a favorite instrument for traders and has the biggest market cap in comparison to other cryptocurrencies in the market. All cryptocurrencies are extremely volatile and subject to various market factors.

*Subject to operator availability.

FAQs

Bitcoin is a decentralised cryptocurrency introduced in 2009 that uses blockchain technology to enable secure, government-free transactions.

Bitcoin mining involves solving complex equations to validate transactions, with miners earning Bitcoin rewards that halve every 210,000 blocks.

Bitcoin was the first cryptocurrency in history, influencing global digital finance and inspiring the creation of countless other cryptocurrencies.

Bitcoin has a hard cap of 21 million coins.

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.