JPY Falls on Export Slump; Nintendo Hits Record High

Japan experienced its biggest drop in exports in 8 months as the country grapples with a sharp decline in trade with the United States. The data, released on 18 June, weighed on the Japanese yen, already near 1-month lows after the Bank of Japan left interest rates unchanged this week.

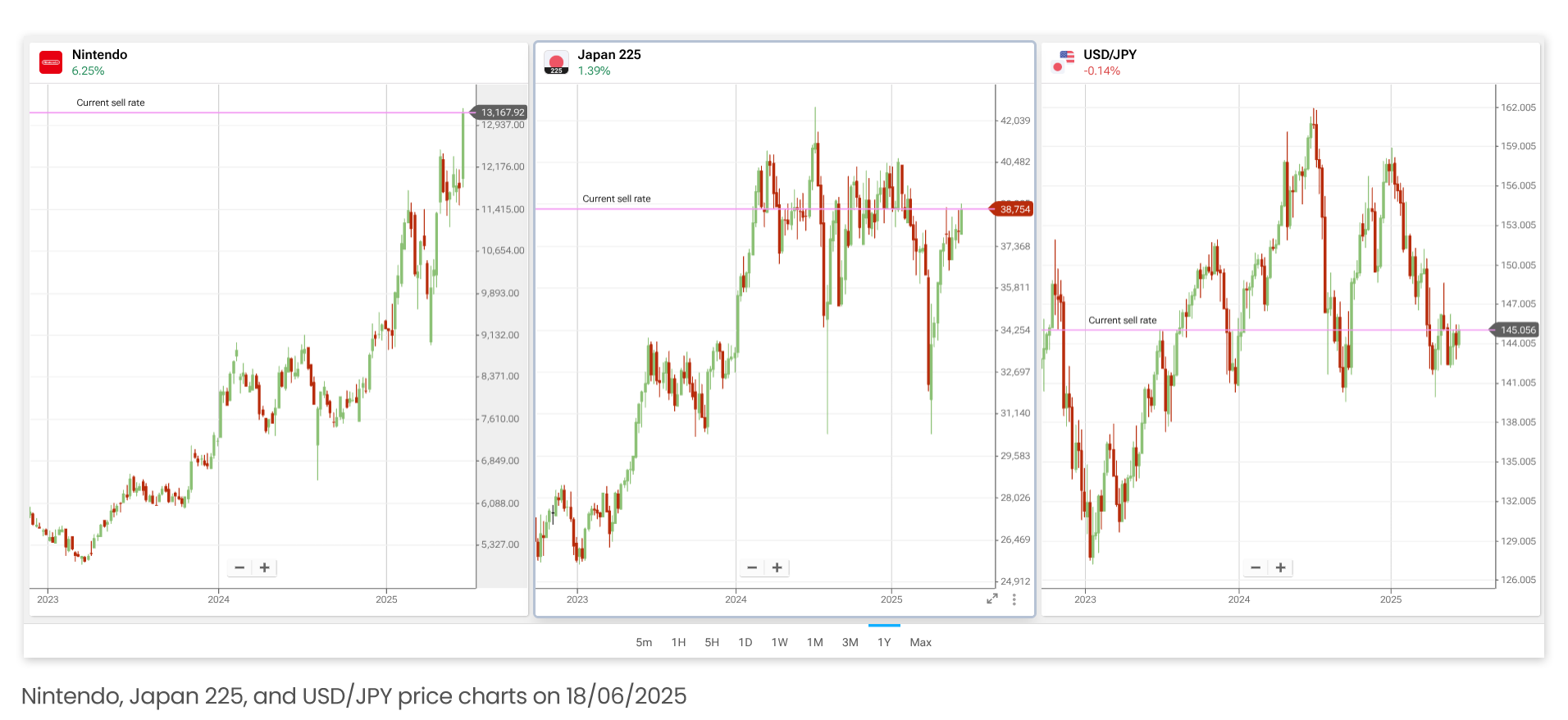

Bucking the trend, Japanese gaming giant Nintendo (7974.TY) saw its stock reach a record high as investors reacted enthusiastically to the high demand for its new Switch 2 gaming console.

Here’s what you need to know:

USDJPY & Nintendo Price Performance

As Nintendo shares hit a record high, continuing a strong uptrend that has seen the price more than double in two years, Japan’s benchmark stock index, the Nikkei 225, remains off the record high set last year, its first in 24 years.

At the same time, the Japanese yen remains stuck in a wide price range, with USD/JPY trading between approximately 140 and 160 over the past 18 months.

*Past performance does not indicate future results

Japan vs Trump’s Trade War

The latest trade data from Japan clearly show the effect of US President Donald Trump's tariffs. Japan’s exports fell 1.7% y/y in May, the sharpest drop since September 2024, as trade with the US continued to weaken. The decline marked a reversal from April’s 2% gain but was less severe than the 3.8% drop forecasted by economists surveyed by Reuters. Exports to the US slumped 11.1% y/y, while overall imports into the world’s third-largest economy fell 7.7%.

The Japanese yen initially fell on the news but rebounded, helped by a weaker US dollar, before today’s (Wednesday) Federal Reserve rate decision. The modest rebound in the yen (drop in USD/JPY) comes after a 3-day losing streak where the dollar gained as a safe haven amid rising Middle Eastern tensions.

Trade Problems Across Asia

China’s economy, too, is starting to feel pressure from the escalating trade tensions with the US. In May, exports were clouded by uncertainty, which prompted Beijing to double down on domestic stimulus to offset weakening external demand.

Retail sales rose 6.4% in May, up from April’s 5.1%, while industrial output grew 5.8%. Fixed asset investment increased 3.7% in the first five months, slightly below earlier gains, as property investment slumped 10.7% year-on-year.

To boost consumer demand, the government rolled out trade-in schemes for cars, appliances and electronics, generating $153 billion in sales by the end of May.

Nintendo: On Top of Its Game

Nintendo shares surged to a new record high on Wednesday, extending a 46% rally this year driven by excitement around the newly launched Switch 2 console. The stock has added a massive $39 billion in market cap in 2025 alone.

The Switch 2, unveiled in January and released this month, sold 3.5 million units in its first four days according to Nintendo. Some stores reported shortages and extended opening hours to meet demand. Nintendo has forecast 15 million units sold by March 2026, but analysts expect that figure to be conservative.

The original Switch, launched in 2017, became Nintendo’s second-best-selling console with over 152 million units sold, just shy of the 154 million by the Nintendo DS. Its hybrid design and popular game franchises like Super Mario, Zelda, and Pokémon have helped drive global appeal. Since the original Switch’s release, the company’s market value has grown by over $81 billion, with shares up nearly 470%. (Source: CNBC)

Conclusión

Japan’s latest trade figures demonstrate the lingering difficulties arising from higher US tariffs, with exports (particularly to the US) under pressure and the yen struggling for direction. Yet amid the broader economic uncertainty, Nintendo stands out as a rare bright spot, buoyed by blockbuster demand for its new Switch 2 console. While Japan wrestles with external headwinds, the success of homegrown champions like Nintendo offers a glimpse of resilience and the kind of innovation that may help offset some of the global drag.

*Past performance does not indicate future results