Bitcoin Mining Stocks 101: Leading Bitcoin Miner Stocks

Date Modified: 12/10/2025

Bitcoin (BTCUSD) has been a prominent figure in financial markets, often hailed as the "king of crypto" since its inception in 2009.

While Bitcoin and cryptocurrencies were once viewed with scepticism due to their youth and nascent nature, today, an increasing number of traders and investors may be exploring ways to potentially capitalise on their price fluctuations, especially since Bitcoin has frequently made headlines in recent years, marked by significant volatility.

Despite being embraced by some countries for trading, others remain cautious and even prohibit it. However, such restrictions should not discourage traders from considering involvement in this market.

One avenue for gaining exposure to cryptocurrencies without direct ownership involves trading Contracts for Difference (CFDs) on companies engaged in Bitcoin mining.

This is known as "Bitcoin Mining Stocks" or "Cryptocurrency Mining Stocks," and it offers an alternative investment option to traditional cryptocurrencies.

Here's what you need to know:

TL;DR

- Bitcoin Mining stocks are the shares of the publicly traded companies involved in the mining of Bitcoin

- Bitcoin mining refers to the process by which Bitcoin is produced, and Bitcoin transactions are validated

- Bitcoin mining is done by Bitcoin miners who solve complex mathematical problems to validate the transactions

- Some of the most popular Bitcoin Mining companies include Cleanspark, Riot Platforms, Hut 8, and Bitfarms

Bitcoin Mining Explained

What Is Bitcoin Mining?

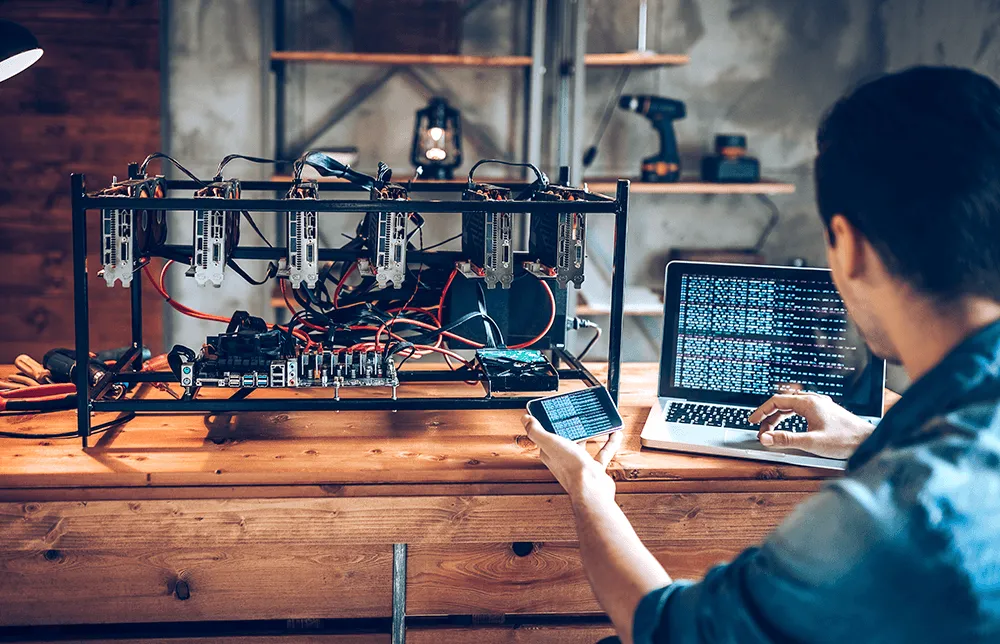

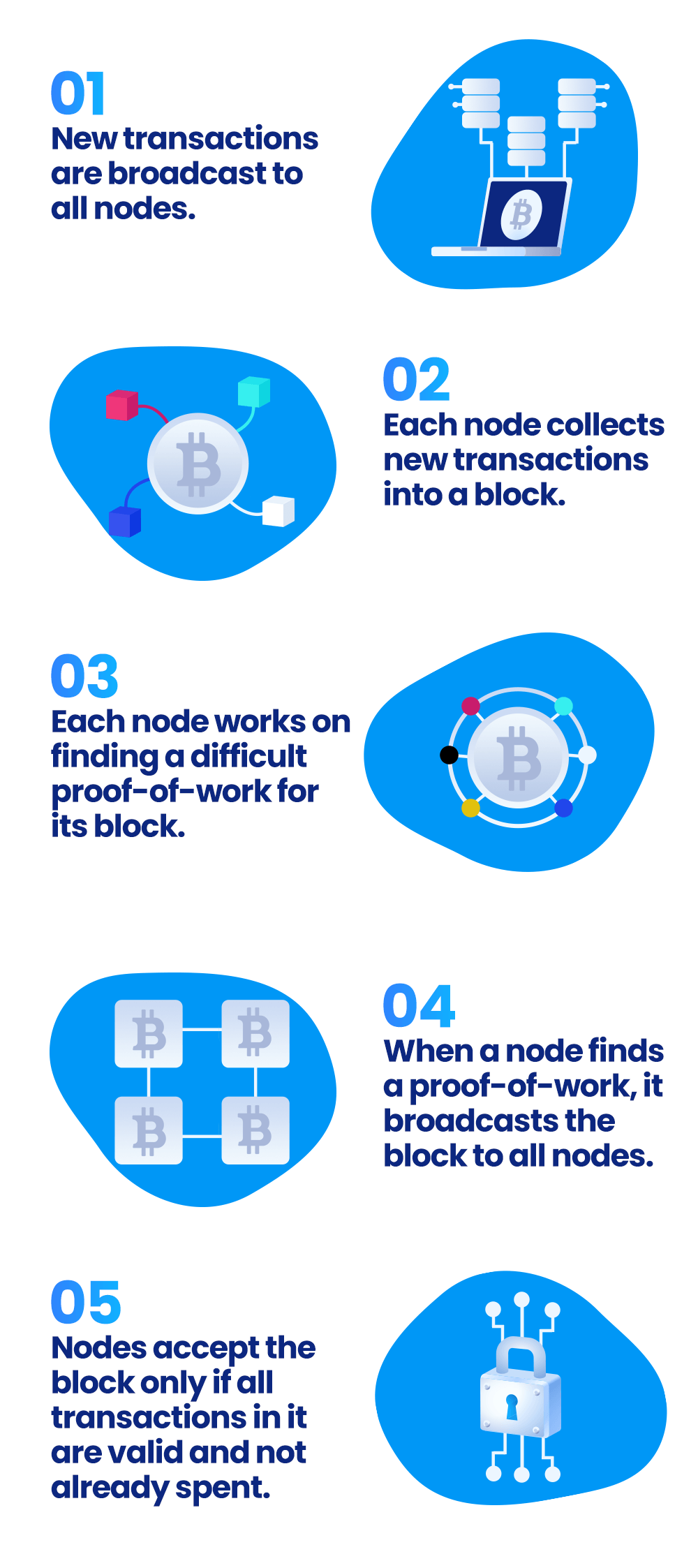

To understand Bitcoin Mining stocks, it's essential to grasp the concept of Bitcoin mining itself. Bitcoin, considered a scarce cryptocurrency, undergoes a process called mining for its creation. Mining involves solving complex cryptographic puzzles (mathematical problems), requiring technical expertise and powerful computers. This process consumes substantial energy.

Who Mines Bitcoin & How Is Bitcoin Mined?

Bitcoin mining is done by individuals who are called "miners" and who do the following:

Why Is Bitcoin Mined?

Bitcoin mining serves two primary purposes: to introduce new Bitcoins into circulation and to validate and secure transactions on the Bitcoin network.

What Are Bitcoin Mining Stocks?

Bitcoin Mining stocks refer to the publicly-listed shares of the companies involved in the mining of Bitcoin or other cryptocurrencies. These companies, also referred to as Crypto Shares or Cryptocurrency Shares, can provide traders with exposure to the crypto market without having to trade or own the actual cryptocurrencies.

Bitcoin Miner companies may have large and elaborate data centres that allow the solving of complex Bitcoin math problems.

Leading Bitcoin Mining Share CFDs

There are multiple big names in the Bitcoin mining industry, but some of the biggest Bitcoin Miners' stocks are as follows:

CleanSpark (CLSK)

This company operates and owns data centres. As the name may suggest, Cleanspark operates on low-carbon power support Bitcoin.

- Sector: Technology

- Industry: Tech and Software

- Founded: October, 1987

- Headquarters: Henderson, Nevada, USA

Riot Platforms (RIOT)

This Bitcoin Miner company purchases blockchain and crypto companies and supports them.

- Sector: Technology

- Industry: Tech and Software

- Founded: July, 2000

- Headquarters: Castle Rock, Colorado, USA

Hut 8 (HUT)

This company provides the necessary infrastructure for blockchain technology and mainly provides services for North American customers.

- Sector: Technology

- Industry: Tech and Software

- Founded: 2017

- Headquarters: Miami, Florida, USA

Bitfarms (BITF)

This company serves as a blockchain tech and provides computing power to Crypto networks ranging from Bitcoin to Ethereum.

- Sector: Technology

- Industry: Tech and Software

- Founded: 1981

- Headquarters: Toronto, Ontario, Canada

Marathon Digital Holdings (MARA)

This company mines cryptos, generates them, and operates digital asset technology.

- Sector: Technology

- Industry: Tech and Software

- Founded: February, 2010

- Headquarters: Fort Lauderdale, Florida, USA

Bitcoin Halving and Its Effect on Bitcoin Mining Stocks

The Bitcoin Halving is an event that takes place once every four years and refers to the cutting of Bitcoin production in half.

Accordingly, this event can cause market volatility and impact the price of Bitcoin and Bitcoin Mining stocks.

The last Bitcoin Halving event took place on April 19, 2024, and marked Bitcoin's fourth halving since its inception back in 2009.

Ahead of this Halving, Mining stocks experienced volatility as many of them plummeted. In addition, after this event, many of the leading Bitcoin Mining stocks kept experiencing losses. This is due to the fact that the Halving causes Bitcoin miners' awards to be cut in half. In other words, Bitcoin miners (including Bitcoin mining companies) will keep doing the same work for less rewards, hence affecting these companies' revenues. However, only time will tell how these companies will perform in the future.

Trump's Victory & Its Effects

According to many market experts, the impact of Donald Trump's election victory and his expected policy stance toward cryptocurrencies sparked optimism among Bitcoin miners and related shares. Hut 8, Riot Platforms, and CleanSpark, in particular, saw increases in stock price in the month following the November 2024 election. Furthermore, Trump's promises to dismantle restrictive regulations and bolster national crypto reserves sent Bitcoin prices into the six-digit range for the first time, which also bolstered renewed interest in mining companies that validate blockchain transactions and earn Bitcoin as rewards.

Bitcoin miners' stock prices often move in tandem with Bitcoin's value, as their revenues depend on both mining output and transaction fees. Recent market dynamics have led to widened profit margins for miners, although they face challenges such as rising energy costs and increasing mining difficulty. Trump's pro-energy policies could provide relief by reducing operational expenses, potentially boosting the profitability of these companies.

However, mining stocks offer a unique risk-reward profile. Unlike Bitcoin itself, miners capture only a fraction of the cryptocurrency's price gains while remaining vulnerable to price downturns. Additionally, the fixed nature of Bitcoin's supply schedule means miners face diminishing block rewards over time, further pressuring their margins.

Investors eyeing mining stocks should weigh their exposure carefully, balancing potential benefits from favourable policies against the inherent risks of a volatile and resource-intensive industry. While, as of December 2024, the perception of the president-elect as being a crypto booster remains strong, it remains to be seen what policies in this sphere will be enacted once he enters office and what effects these will have on Bitcoin mining stocks in particular.

Trading Bitcoin Mining Share CFDs

While one can purchase the aforementioned stocks through traditional stock trading platforms (like Plus500 Invest*), one may also choose to trade Contracts for Difference (CFDs) instead. CFDs are derivative contracts between two parties, allowing them to trade on both rising and falling Bitcoin Mining stocks' prices without having underlying ownership of the stocks.

This type of contract is leveraged, meaning that both gains and losses can be amplified.

To learn more about how CFDs work, you can watch our Trader's Guide video titled "What Is CFD Trading."

*Availability based on regulation

Benefits and Risks of Trading Bitcoin Mining Share CFDs

Before delving into the world of Bitcoin Mining stocks, it may be worth keeping in mind the risks and rewards associated with it:

Pros

Bitcoin Mining share CFDs can present traders with the possibility of profile diversification and exposure to the potentially rewarding world of cryptocurrencies, without requiring that they invest or trade the actual cryptocurrencies.

While some may be bearish on the growth potential of cryptocurrencies, in general, and Bitcoin, in particular, many market experts believe that this field is poised to grow further in the future. This, in turn, may present itself as a possible advantage to those seeking more trading opportunities.

Cons

Despite its allure, there is no doubt that Bitcoin and cryptocurrencies are volatile assets that can lead to notable losses. In addition, while regulations are getting better, the regulation of cryptos is generally less developed compared to other types of market assets. Additionally, the mining of Bitcoin is an inherently risky business that demands lots of money and operational and technological advancements and can be accompanied by risks. This, in turn, can lead to companies experiencing losses if they are not equipped with the necessary tools to tackle such challenges.

In case you think this is the appropriate type of trading for your needs, you can trade Bitcoin Mining CFDs with Plus500.

Conclusion

In conclusion, the Bitcoin Mining field can present traders and investors with numerous trading opportunities. However, this can also be accompanied by many risks.

As such, equipping oneself with the necessary knowledge and risk management skills is crucial before delving into this fascinating, yet, complicated market sector.

FAQs

You can trade Bitcoin Mining stocks with Bitcoin Mining stock Contracts for Difference (CFDs) with a provider like Plus500.

The Bitcoin Halving led to losses among leading Bitcoin Mining companies' stocks.

Whether or not you should trade Bitcoin Mining share CFDs depends on your risk tolerance, goals, and overall ability to tackle the volatility of the cryptocurrency market.

As of May 2024, some of the most popular Bitcoin mining stocks include Cleanspark, Riot Platforms, Hut 8, and Bitfarms.

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.