How Bitcoin and Blockchain Work?

Date Modified: 31/12/2024

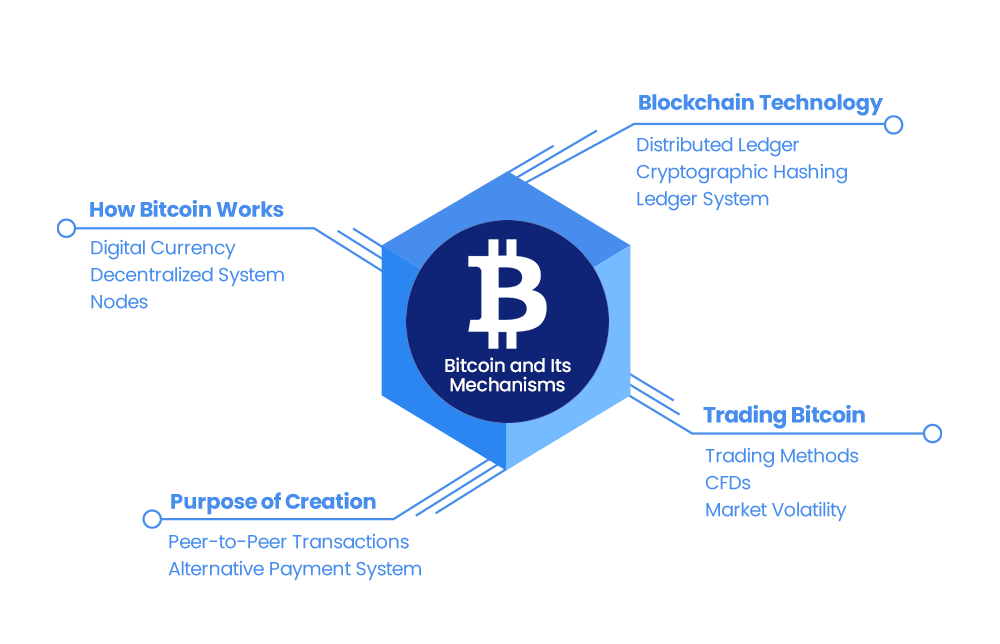

Since its inception in 2009, Bitcoin has become one of the most popular cryptocurrencies out there, it is not only considered the father of digital coins, but also one of the most traded cryptocurrencies with a market cap of about $1.92 trillion. Bitcoin's ubiquity speaks for itself, but how does it work exactly?

Bitcoin is a form of digital currency that can be used to pay for goods and services anywhere that it is accepted. This is similar to how fiat currencies, such as the US Dollar (USD/JPY), British Pound (GBP/USD), Euro (EUR/GBP), and others are used for trade.

However, instead of being monitored by a central bank to certify authenticity and legitimacy, Bitcoin relies on a decentralised system. This means that no central system controls the currency. Rather, a collective of independent individuals offer their own computing power (nodes) to monitor, review, and approve transactions.

TL;DR

- Decentralisation: Bitcoin operates without central control, using blockchain for transparency.

- Purpose: Created for peer-to-peer transactions without third parties.

- Trading Options: Traders can own Bitcoin or trade CFDs for leveraged positions.

- Volatility: Bitcoin's price swings attract traders but carry significant risks.

The Purpose Behind Bitcoin's Creation

The main purpose behind creating Bitcoin was to act as a way for people to transact money over the internet without having to have a third party involved in that transaction. In other words, unlike traditional bank transactions, Bitcoin was created with the intention of it serving as an alternative payment system that operates free of control (decentralised) through the use of blockchain technology.

What is Blockchain Technology, and How Does It Work?

Blockchain or Distributed Ledger Technology refers to the format followed by many cryptocurrencies to verify that a payee is the legitimate owner of the coin through decentralisation and cryptographic hashing. It does this by keeping a ledger (a record-keeping system) of each coin's movements when being passed to the new owner. Approving each transaction also ensures that movements are in line with the network's protocols.

All independent nodes (network stakeholders) have access to ledgers that hold information as to who owns the coin at any given time and can confirm the legality of each block. Each transaction or packet of data is referred to as a 'block' and the ledger can link them all together in chronological order. This is how the 'blockchain' became synonymous with Bitcoin, since it uses blockchain methodologies to keep the system transparent and honest.

Illustrative prices.

Bitcoin Trading Information

Traders who trade Bitcoin and other cryptocurrencies with Plus500 can generally do so 24 hours a day. Furthermore, CFDs on Bitcoin exchange-traded funds offer an alternate option for those seeking to capture crypto price movements.

Having continuous access to the real-time price for this digital coin ensures that traders can confidently open and close positions without worrying about digital wallets or a lack of buyers in the market.

While many digital currencies, from Ethereum to various altcoins, have risen in popularity since the minting of Bitcoin, none have reached its relatively high valuation or rate of adoption. The short history of Bitcoin and other cryptocurrencies is full of speculation, rapid highs, and deep lows. Traders should be aware of the volatile nature of all cryptocurrencies and remain vigilant to the price movements for their open trades.

*Subject to operator availability.

FAQs

Bitcoin enables peer-to-peer transactions without the use of banking services.

By recording and verifying transactions on a decentralised ledger.

They allow trading price movements without owning Bitcoin, although they also carry significant financial risks.

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.