Can You Trade Cryptocurrencies Using a Forex or CFD Platform?

Can you trade cryptocurrencies on forex/CFD platforms? The short answer is yes, you can. However, there are significant variations that apply to crypto trading on forex and CFD platforms that must be taken into account when compared to trading the underlying asset on a crypto exchange.

How are Cryptos Traded on Forex/CFD Platforms?

It must be noted that what is traded on most forex/CFD platforms are cryptocurrency CFDs. In other words, the trader is entering into a contract with the CFD provide on an underlying asset (such as Bitcoin). These derivatives are based on the price movements of their underlying assets but do not involve an exchange or ownership of the digital cryptocurrency itself.

This means that there are no actual cryptocurrencies that are being exchanged, nor are there wallets or addresses to worry about. This also reduces the hacking risks that pose a real threat to even the best and most reliable crypto exchanges. CFD traders can focus on how to take advantage of market movements. Profiting from cryptocurrency trading on forex/CFD platforms is possible when you have a Buy position and the sell rate of the cryptocurrency increases above its opening buy rate; if you have a Sell position, you profit when the buy rate of the cryptocurrency falls below its opening sell rate. Vice versa: buy positions will be in loss if the sell rate falls below the opening buy rate and sell positions are in loss when the buy rate rises above the opening sell rate.

How Is Cryptocurrency Trading On Forex/CFD Platforms Different from Exchange Trading?

There are some main differences between trading cryptos on a forex/CFD platform and on an exchange:

- No digital cryptos are exchanged in any of the trading transactions.

- There is no requirement to own a cryptocurrency wallet.

- You trade cryptos under the terms and conditions agreed with the forex/CFD provider.

- Crypto CFD trading is leveraged.

- You get to trade crypto-fiat pairings such as the BTC/USD or LTC/USD pairs, as opposed to a majority of crypto exchanges where you can only trade crypto-to-crypto pairs.

- You can only make deposits and withdrawals using fiat currencies.

The Process of Trading Cryptocurrency CFDs

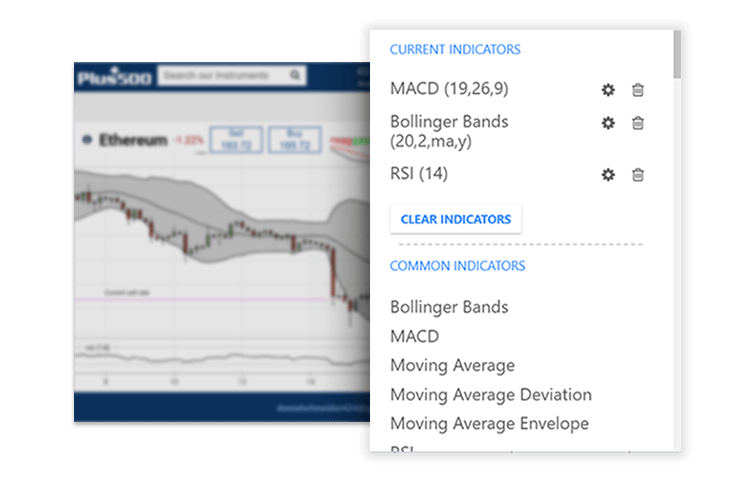

If you have traded forex or CFDs on any of the popular MT4 platforms, then you should not have any issues understanding the process of trading cryptocurrency CFDs. They are usually listed just like any other CFD instrument on the platform. Here’s an example from Plus500’s WebTrader:

Illustrative prices.

Trading a cryptocurrency on a CFD platform such as Plus500’s involves technical (relying on market statistics) and fundamental (trading based on live economic news) analysis, as well as a balanced trading psychology and a good set of risk management tools. Risk management is especially important because cryptocurrency pairs are some of the most volatile assets on any CFD trading platform. Prices move in tens and hundreds of currency units a day, as opposed to forex assets that have minor movements in decimal percentage points, or volatile commodity assets like Crude Oil that only move in single currency digits per day. The ability to control your risk while deploying technical and fundamental strategies can make a big difference to your potential profits or losses.

Take a look at the image below to see how technical analysis and indicators are used on the chart to identify trends and patterns.

Illustrative prices.

When it comes to fundamental analysis, news coverage is very important to the price movements of major cryptocurrency CFDs. Sources of news for cryptos include some major cryptocurrency websites or their social media pages. You can also follow market news through our free News and Market Insights articles.

Nevertheless, there are two sides to the story when it comes to cryptocurrency news. Firstly, there is no economic calendar to work with, so you cannot really know when market-moving news will be released. Secondly, the kind of crypto news that moves the markets is centred around a few points: adoption, favourable declarations by regulators and being listed on a major exchange.

Pay Attention to Price Correlations

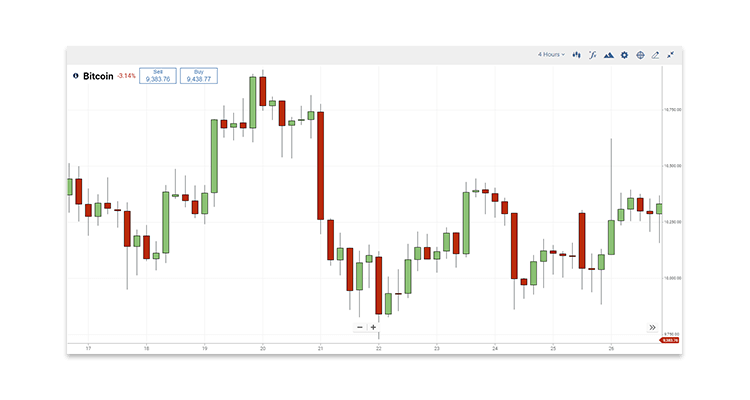

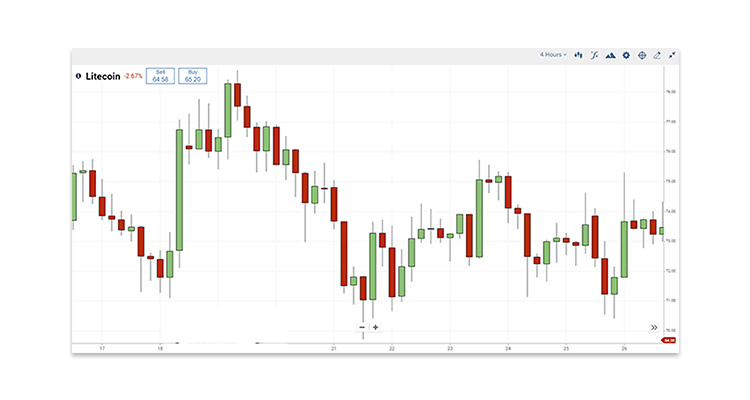

You should also pay attention to correlations. For instance, Bitcoin Cash ABC and Litecoin were built with Bitcoin’s structure and are essentially clones of Bitcoin (also referred to as altcoins). Therefore, Bitcoin tends to drag Litecoin prices wherever it goes. Take a look at the two charts below for BTC/USD and LTC/USD, taken in the same time frame.

Illustrative prices.

Illustrative prices.

Do you see any resemblance in these two charts? You can see that the chart for LTC/USD mirrors that of BTC/USD, showing that Bitcoin and Litecoin have a strong correlation.

Conclusion

These are the basic elements of what it takes to trade cryptocurrencies on forex or CFD platforms. Pay attention to the news - anything you hear about cyberattacks or regulation changes will impact cryptos’ movements, as will news about hard forks. You should also pay attention to correlations at prices between similar cryptos such as LTC and BTC. Remember, Plus500 offers you CFD trading access to the major crypto assets.

*Instrument offering is subject to operator.