What Is Cryptocurrency Trading?

Cryptocurrency trading means taking a financial position on the price direction of individual cryptocurrencies against the dollar (in crypto/dollar pairs) or against another crypto, via crypto to crypto pairs. CFDs (contracts for difference) are a particularly popular way to trade cryptocurrencies as they allow for greater flexibility, the use of leverage and the ability to take short as well as long positions.

The Growing Popularity of Cryptocurrency Trading

Over the past decade, since the internet debut of Bitcoin in 2009, cryptocurrency trading has become increasingly popular. For example, while in 2013 there were only 66 types of cryptocurrencies, as of February 2022, there are over 10,000 cryptocurrencies available. This staggering growth is a distinct testament to crypto’s growing popularity. Cryptocurrencies are digital coins that are created using blockchain or peer-to-peer technology that uses cryptography.

They differ from fiat currencies issued by governments from around the world because they are not tangible: instead, they are made up of bits and bytes of data. Moreover, cryptocurrencies do not have a central body or authority such as a central bank that issues them or regulates their circulation in the economy. As cryptocurrencies are not issued by any government body, they are not considered legal tender.

Even though cryptocurrencies are not recognised as legal tender in the global economy, they have the potential of changing the financial landscape and this makes them hard to ignore. At the same time, the blockchain technology, which forms the foundation of cryptocurrency creation, has opened up new investment opportunities for traders to capitalise on.

Types of Cryptocurrencies

While there are currently hundreds of cryptocurrencies available, traders' interest appears to be focused on approximately half a dozen cryptocurrencies. Included in the list of most popular cryptocurrencies are Bitcoin, which is regarded as the original cryptocurrency. Due to a “hard fork” in the original Bitcoin blockchain, Bitcoin branched out two new additional virtual coins: Bitcoin Cash and Bitcoin Cash ABC. Other popular cryptocurrencies that are frequently traded on cryptocurrency exchanges and online CFD trading platforms, include Ethereum, and Litecoin, Cardano, Solana, Axie Infinity, Filecoin, Uniswap and more.

Popular cryptocurrencies can be broken down into several main ‘types’. There are those intended to offer an alternative to fiat currencies. These include Bitcoin, Bitcoin Cash ABC and Litecoin. Ethereum, on the other hand, is only intended to be ‘spent’ to use the Ethereum smart contracts platform, which can be used to build decentralised applications (Dapps). Ethereum is, therefore, considered more of a ‘utility token’ than a currency. Conversely, Stellar is used as a blockchain-based payments platform. Finally, there is the Crypto 10 index, which can be compared to a stock market or currency index but is made up of the 10 largest and most liquid cryptocurrency assets.

Bitcoin (BTC)

In 2008, Bitcoin or BTC was the first cryptocurrency that was introduced to the world. This cryptocurrency was the first to adopt blockchain technology. Today, Bitcoin has become one of the most valuable cryptocurrencies in the industry with its value surpassing even that of gold.

Bitcoin Cash (BCH)

Bitcoin Cash is the result of a hard fork that occurred on the original Bitcoin blockchain in August 2017. The change was an attempt to allow for larger blocks on the original blockchain, therefore allowing for faster processing of transactions.

Bitcoin Cash ABC (BAB)

The result of another ‘hard fork’, this time in the Bitcoin Cash blockchain on November 15, 2018. The hard fork was the result of an upgrade to the Bitcoin Cash blockchain software that Bitcoin Cash Adjustable Blocksize Cap (which is where the ‘ABC’ comes from) wanted to introduce. At this time, Bitcoin Cash Adjustable Blocksize Cap was the largest software client for the blockchain. The aim of the upgrade was to introduce the possibility for non-cash transactions like smart contracts and oracle prediction services. Those behind the fork also wanted to replace canonical transaction ordering with topological transaction ordering.

However, not all the members, or nodes, on the Bitcoin Cash network agreed to the upgrade, so when the updates were introduced, another hard fork took place, resulting in Bitcoin Cash ABC.

Axie Infinity (AXSUSD)

Released in March 2018, Axie Infinity is a ‘play-to-earn’ (P2E) Ethereum-based online game that involves a virtual universe containing pet avatars called Axies which players collect in order to battle, raise, and build kingdoms. AXS is the name of the token given to players for participating in the game which is what is known as ‘play-to-earn’ (P2E). This cryptocurrency game also participates in the developing realm of non-fungible tokens (NFTs) since the Axies avatars are unique and can be bought or sold as NFTs. As of March 2022, this cryptocurrency game earned an astonishing market capitalization of about $33 billion.

Filecoin (FIL)

Filecoin was first introduced in 2014, it is a decentralized ‘peer-to-peer’ (P2P) Cryptocurrency Operated Storage Network that provides storage services for anyone who wants to store their files or help others store their files on it. Users who rent storage space get paid in FIL tokens. Filecoin’s market capitalization is valued at $4.8 billion as of March 2022.

However, not all the members, or nodes, on the Bitcoin Cash network agreed to the upgrade, so when the updates were introduced, another hard fork took place, resulting in Bitcoin Cash ABC.

Uniswap

Run on the Ethereum blockchain, Uniswap is a fully decentralized crypto exchange which emerged in 2018 as part of the Ethereum blockchain. It runs on smart contracts that work on adding and facilitating the swap or “trade” of the Uni tokens. As of March 2022, Uniswap has a market capitalization worth $3 billion and is considered the 4th largest decentralized finance (DeFi) platform.

Crypto 10 Index

The Crypto 10 Index is an index designed to offer a tradable benchmark for the cryptocurrency asset class. It is comprised of the 10 largest, most liquid cryptocurrencies and tokens, with prices an average of those on multiple major exchanges. The index was standardized at 1000 points on 23 December 2016 and as of 9 January 2018 has been recalculated against the market movements of its 10 constituents on an ongoing basis.

Ethereum (ETH)

Designed to be a fast way to process transactions, Ethereum is a blockchain network that was developed based on the original Bitcoin blockchain technology. The cryptocurrency was first proposed by Vitalik Buterin in November 2013.

Litecoin (LTC)

Litecoin was introduced to the cryptocurrency world in October 2011 as an attempt to facilitate cross border payments. It was designed to offer faster verification of transactions compared to Bitcoin.

What Determines Cryptocurrency Prices

- Cryptocurrencies are limited in their supply, and unlike regular fiat currencies, they are considered more rare. Accordingly, the lower the supply and the higher the demand for a cryptocurrency, the higher its prices will get.

- New cryptocurrencies are produced through the process of mining, which involves operating computers to verify the blocks on the cryptocurrency’s blockchain. This process is costly and demands a lot of electricity. The higher the cost of mining the more a cryptocurrency’s value increases.

- Cryptocurrencies that have more competition tend to be less valuable than those that tend to have more traction and fewer competitors.

- Apart from being the foundation for the creation of cryptocurrencies, blockchain technology has wider implications in the global economy, including the potential application in smart contracts and in the field of Internet of Things (IoT). As cryptocurrencies were only introduced in the last decade and are not considered a legal tender, they are not subject to the same market forces as traditional markets. This means that trading in cryptocurrencies is not like trading in traditional financial markets.

- Due to the centralised nature of cryptocurrencies, their price movements are less affected by factors such as data releases, political uncertainty, and interest rate changes. In addition, because they are a new type of financial instrument, cryptocurrencies have relatively few correlating assets which could affect their price movements.

- Nevertheless, the prices of cryptocurrencies can be affected by several factors such as changes in blockchain technologies and regulatory attempts to control their acceptability and ‘tradeability’ in the financial markets. News reports such as disagreements on how a particular cryptocurrency should be upgraded or processed can also affect its price. It is likely that any security flaws exposed by hackers will also adversely affect the price of a cryptocurrency. Of course, government policies and regulations that seek to ban or limit the sale of cryptocurrencies will also affect its price.

How Are Cryptocurrencies Traded?

Cryptocurrencies can be traded in several ways. The first way is to deal in the digital crypto coin itself by buying and selling it on a cryptocurrency exchange. Another way of trading cryptocurrencies is by means of derivative financial instruments, such as Contracts for Difference (CFDs), which you are able to trade on the Plus500 platform. The latter has gained a lot of popularity in recent years as it involves less capital outlay while at the same time enabling traders to speculate on the price movements of the cryptocurrency, without having to actually own them. Furthermore, CFDs are leveraged which means that with a smaller initial margin, traders can potentially give more value to their positions as their gains can be magnified. In addition, trading CFDs on cryptocurrencies means that you don’t have to worry about storing them in a crypto wallet as you would if you were to trade them through an exchange. Nonetheless, traders should bear in mind that trading CFDs comes with many risks and that while leverage can magnify their gains, it can also increase their losses.

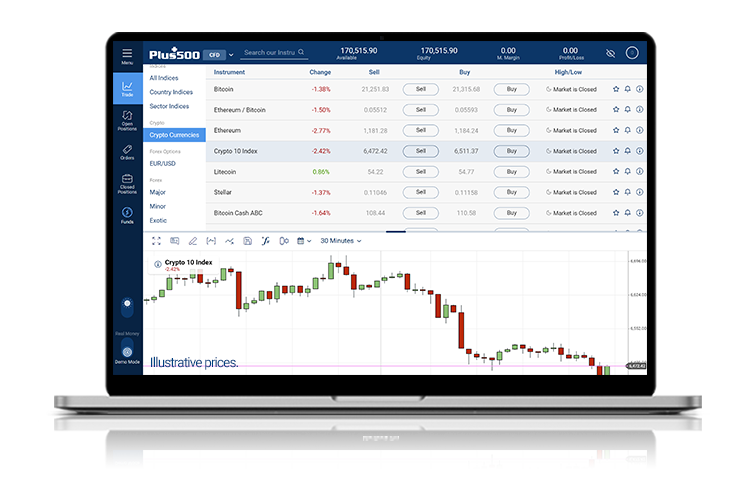

As you can see in the image below, a selection of different crypto CFDs are available for trading on the Plus500 platform.

Illustrative prices.

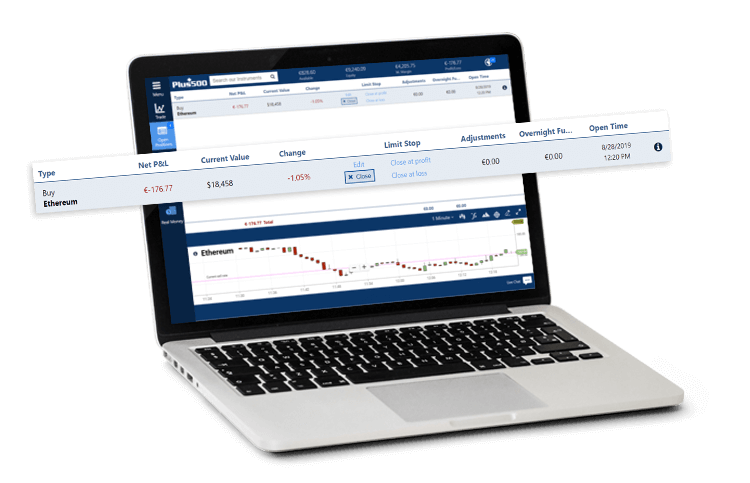

Once you have selected the cryptocurrency you wish to trade, you must then choose to open a SELL or BUY position. Either action will open up a trading window, as you can see below. From here you can select the amount of contracts and choose whether to implement any risk management orders, such as Stop Loss or Take Profit, which are activated once a certain price is reached. The screenshot below is an example for illustrative purposes only - in this case, to place a SELL trade the trader would click on the SELL button.

Illustrative prices.

Once you are ready to close the position you can click on the close button.

Illustrative prices.

Is Cryptocurrency Trading Right For Me?

Cryptocurrency trading, just like all forms of financial trading, requires relevant knowledge, skills, and available capital. If you wish to trade the cryptocurrency market, you should first ensure that you have all the relevant skills for analysing the market. It should be noted that cryptocurrencies are more volatile than traditional instruments and, hence, riskier than most people are used to. This volatility can provide more opportunities for making a profit, but remember it can also result in losses that are greater than what you may be willing to bear.

Starting To Trade Cryptocurrencies

If you do decide that trading cryptocurrencies is right for you, you could start by opening a trading account with Plus500. You can then choose the crypto CFDs you want to trade from the rich selection on offer and open a position when your analysis tells you the time is right.

*Instrument offering is subject to operator.