Share Trading Strategies

In the world of trading, strategies are key to improving your chances of profitable returns, and a way to potentially reduce your risk. A good stock trading strategy takes into account the particular stock you’re planning to trade, the market conditions and any relevant information regarding the company and industry. In addition, you should know the amount of risk you’re willing to take, as well as understand your personal needs and preferences. Strategies should be carefully crafted and tested in order to try to minimise the chances of losing money.

Here are some of the most common active trading strategies that you can use when trading CFDs with Plus500. Use them, together with our Stock Trading Tips, to craft your own strategies. The strategies you create must be based on your own preferences, your available risk capital, risk tolerance, the time you can dedicate to trading and your trading experience.

Day Trading

Day trading implies opening and closing a position on the same trading day. It relies on short-term market movements. It requires in-depth knowledge of the stock being traded and the general market it belongs to. Day traders need to predict the asset’s price moves based on news, earnings reports, PR disasters or interest rates. Basically, any event in a particular company can cause volatility, and day traders aim to profit from it. In addition, day trading requires knowledge of the general markets and what makes them move, as well as a good understanding of the general sentiments that drive the market. Moreover, since day trading focuses on quick moves, it is crucial to be constantly available to act quickly.

Keep in mind that day trading requires focus and a lot of work. It is imperative to understand the market, the stock you want to trade and any chart or analysis tool being used. If you plan on day trading, make sure you have access to several reputable news sources, and are well-versed in the different indicators, charts and drawing tools available to you. You can also utilize Plus500’s free Economic Calendar tool in order to stay up-to-date on market events that might affect your trading as well as set-up trading alerts to get real-time updates on the market.

Position Trading

Unlike day trading, position trading uses less screen time and is less immediate. Position trading is based on identifying trends in order to benefit from the changing directions of the market. This type of trading concentrates on overall price moves. Traders typically enter a trade once the trend is settled and leave once the trend changes. Accordingly, this may mean holding a position for a couple of days or a few months. Contrary to day trading, where traders attempt to capture smaller movements by buying and selling on the same day, position traders usually place fewer and bigger trades, looking for substantial gains over longer periods of time. While this type of trading doesn’t require full monitoring, it is important to stay on top of what’s going on with the relevant stocks.

Moreover, analysis (mainly fundamental but also technical) plays a big role in position trading because it’s the basis of identifying the trends that will determine what position to enter, or leave, and when. The key is to find the predictable patterns and trends and the stocks that have them.

Swing Trading

Swing trading is a strategy in which you hold the stocks for a relatively short period of time, until there are price changes (swings). It uses technical analysis tools, such as charts and indicators, to identify patterns and trends. Identifying the price swings allows you to know when to enter and exit your trades in order to catch and ride the wave before it crashes.

When choosing swing trading as your strategy, it’s best to choose stocks with high trading volume because they are more likely to have price swings. Swing trading usually aims at smaller profit margins per trade, that can add up to larger sums, and can be held from days to weeks.

Reading this, you might feel a certain similarity between swing trading and day trading, however, the two mainly differ in the aspect of time. Day trading is more immediate than swing trading, and day traders generally do not hold an open position overnight like swing traders.

We have looked into the most active trading strategies. Other trading strategies include technical trading, positional trading, breakout trading, arbitrage, news trading and more.

Entering and Exiting Trades

As important as choosing a trading strategy is, knowing when to enter and when to leave a trade are key parts of any trading strategy, and will play an important role in affecting the results of the trade. This is because the price difference from when you enter the trade and when you leave it will be your profit/loss.

While you can never get a definitive answer on when to exit or enter a trading strategy, there are a few factors that can be taken into account that may help you decide.

Entering a Trade

In order to know when to enter a trade, it is important to analyse the market and understand what moves the various stocks in the short and long term. See What Defines a Share Price for more information about the factors that affect share prices. This knowledge will help you identify the most suitable stocks for you to trade and the strategy to build around them.

Part of your analysis may be using indicators which help you understand volume, price swings and trends and choose when to enter a trade. With Plus500, if your desired entry point is not the current price, you can set price alerts to let you know when the stock reaches a particular rate, or set a future (pending) order for the system to open a position automatically at your desired price. If setting a future order, keep in mind that slippage can occur.

Exiting a Trade

You can exit a trade with profits or losses. While the aim of any investor is always to make money, not all trades will be profitable. You need to know when it’s best to take your profits, when to let them run to try to gain more, and when it’s best to realise your losses.

It’s important to have planned your trading strategy and be sure in advance on what kind of price movements you’re expecting in order to exit the trade; Generally speaking, if you’re trading short term positions, you need to be more careful and more exact about your exit points to reduce risks. You can close your positions manually, or you can set stop orders that will close them automatically for you. Stop Limit orders allow you to lock in profits, while stop loss orders will limit your losses. You can also set a trailing stop, which is more dynamic and will move according to the position’s performance.

Other Things to Consider

Position sizes

The size of your positions refers to the number of contracts that you buy or sell in a given trade. The bigger the position, the more funds invested in it, and the higher the risk. As a retail investor, an important tip is to not risk more than 2% of your investment capital in a single position. In order to determine the optimal position size, you also need to know how much money you’re willing to risk in each trade. You can then calculate accordingly, taking into account the capital you have available for trading and the price of the shares you’re interested in.

Risk management

First, you need to consider your finances and decide how much capital you want to invest. Preferably, you must use funds that are dispensable and non-essential, in case your trades don’t go as planned. You also need to know how much you’re willing to risk with each trade and plan accordingly. Remember that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

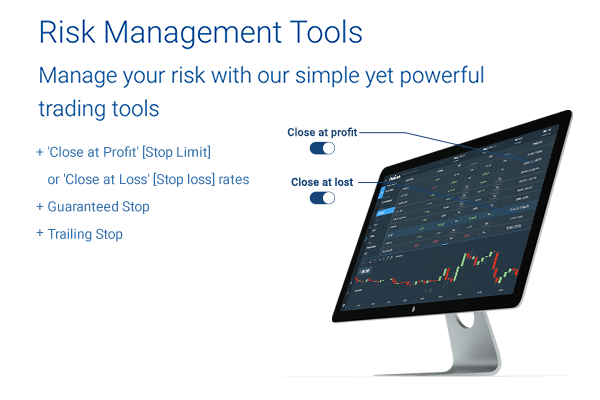

Having a solid, tested trading strategy that fits your needs is the basis of risk management in trading, because it allows you to maximise potential profits and may limit risks. Risk management tools are available for you to use when trading CFDs on the Plus500 platform. They will allow you to be more exact at your exit points, so that you can trade as close to your analysis and strategy as possible.

As a trader it is important to practice before you risk your funds. Trading in the demo mode will allow you to get used to the trading platform you choose, understand the world of trading, and test your strategies. Only after you feel comfortable with all aspects of trading, you use real money, and only if you can afford the possibility of risking your capital.

Illustrative prices.