Forex CFDs Explained

Date Modified: 08/02/2024

Before trading Forex CFDs one must understand what CFDs are, how they function, and the benefits and risks of trading them. CFD is an abbreviation for a ‘contract for difference.’ It is a form of trading that allows you to speculate on the price movements of different asset types, like currency pairs, shares, commodities or even cryptocurrencies*. Rather than settling the underlying asset, you are trading on the price movement of the underlying asset.

Below we will look at Forex CFDs in greater detail.

Illustrative prices.

What Are Forex CFDs?

If you are looking to trade Forex CFDs, then you need to understand the underlying foreign exchange market. CFDs merely represent an alternative means of trading on forex currency pairs.

A Forex quote consists of two currencies; the base currency and the quote currency. The currency pair can be a reflection of the strength of one economy versus another, and the exchange rate is a function of the relationship of the two economies. You should try to understand and consider the various technical, political, and economic events that have the greatest effect on each currency.

It is important to understand how Forex pairs are quoted because when you have a firm grasp of the fundamentals of a particular currency pair, you can then investigate how CFDs work.

Forex vs. Forex CFDs

Traditional Forex trading and Forex CFDs trading are not the same thing. On the one hand, the basis of Forex trading is the exchange of a certain amount of one currency against another. For instance, if you were to purchase GBP/USD, you would profit if the pound appreciated against the US dollar (GBP/USD moves higher) or lose money if the exchange rate falls (GBP/USD moves lower).

On the other hand,CFD trading allows you to place leveraged trades on currency pairs, speculating on the movement of the underlying instrument. Rather than settling (or delivering) a set amount of base currency, CFDs are cash-settled, based on the difference between the opening and closing prices of a pair of currencies.

One of the key features of CFD trading is that by using leverage you can increase your trade size while committing a relatively small amount of capital. You should keep in mind that while increasing your exposure magnifies potential profits, it also magnifies potential losses. Below, we discuss the additional pros and cons of Forex CFDs in more detail.

What is the Difference Between a Futures Contract and a CFD?

Forex pairs can be traded in many ways, two of which are futures contracts and CFDs.

Below is a list of the differences between these two financial derivatives.

Future Contract |

CFDs |

|---|---|

Futures are most often traded on exchanges. |

CFDs are offered over-the-counter (OTC). |

Some future contracts have an expiration date, such as Oil, Natural Gas, Gold futures. |

CFDs don’t have an expiry date and can be closed at any time. |

Futures are carried for longer time periods. |

CFDs are short-term speculative products. |

In the futures market, the broker acts as an intermediary, as opposed to a counterparty. |

In CFD transactions, the issuer (for example, Plus500) acts as the counterparty. |

The Benefits and Risks of Trading Forex CFDs

Now that we have outlined how you can trade Forex CFDs, let's cover the benefits and risks of trading them.

If you ever find yourself asking if trading CFDs on Forex is even worth the hassle, keep reading.

Like many instruments, Forex can be a double-edged sword as it comes with its own pros and cons.

In this section, we cover some of the benefits of trading Forex CFDs.

- High Liquidity: the Forex market is extremely liquid as it is active 24 hours during the week, with the exclusion of weekends, and it is actively traded.

- Globality and Grandeur: the Forex market is a large and global one with an average daily trading volume of $6.6 trillion.

- Availability and Accessibility: the Forex OTC (Over the Counter) market is available for trading on weekdays on a 24-hour basis.

Risks of Forex Trading

While the Forex market is multidimensional and carries many advantages, it can also bring with it risks that traders should be aware of. Here are some of the factors that should be taken into account when trading Forex.

- High Volatility: the Forex market has volatile exchange rates, meaning that Forex pairs’ prices can shift in a relatively inconsistent manner over short time spans. Hence, it can sometimes be unexpected.

- Unpredictable Currency Markets: the currency market is affected by multiple factors that include socio-economic changes, political decisions, and more. Therefore, predicting Currency Markets can sometimes be harder to do.

- Traders’ Inexperience: like in any other market, inexperience and lack of education and knowledge can lead to losses. It is, therefore, advised that traders read, educate themselves, and be aware of the Forex market and how it functions.

Even though risks are part of every trade, traders can, nevertheless, attempt to manage the risks of Forex CFDs trading with Plus500’s risk-management tools. Below, we elaborate on how traders can do that.

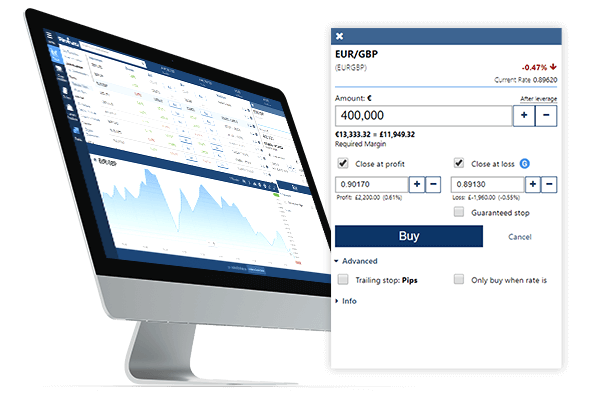

Managing Risk In CFD Trading

As mentioned above, leveraged CFDs, like other derivative products, are risky in comparison to actually trading the underlying asset because of your increased exposure (which can also lead to potentially higher profits but also higher losses). To help manage your risk, Plus500 offers a range of risk management tools that can help you take control of your trades and manage your risks. These include ‘Close at Profit’ (to close trades when they reach a certain level of profit), ‘Close at Loss’ (to limit risk to a certain value), ‘Guaranteed Stop’, and ‘Trailing Stop’. In addition, traders can attempt to calculate their potential profit and losses through risk-reward ratios. Remember that while risk-management tools can potentially help you lower the chance of losses, nothing is guaranteed. Therefore, as with any trading, you should always keep in mind the golden rule: you should never trade more than you can afford to lose.

Illustrative prices.

In addition to the risk-management tools provided on the Plus500 trading platform, Plus500 also has a range of powerful technical analysis tools to help you control your trades and develop trading strategies. However, if you want to test your strategies in real-market conditions, without the risk of losing your money and see how CFDs operate in real-time, you can start by trying our risk-free Free Demo Account - which lets you practise before you trade with real money.

*This article contains general information which doesn't take into account your personal circumstances.

**Instrument availability varies by operator.

Cryptocurrency CFDs are not available to Retail Clients.

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.