What Causes the DAX to Move?

Date Modified: 27/11/2025

The DAX (Germany 40) consists of the 40 largest companies on the Frankfurt Stock Exchange and is a leading stock market index that reflects the health of prominent European and German stocks, offering a snapshot of Germany’s economic trends.

This article explores the DAX 40 and what affects its prices.

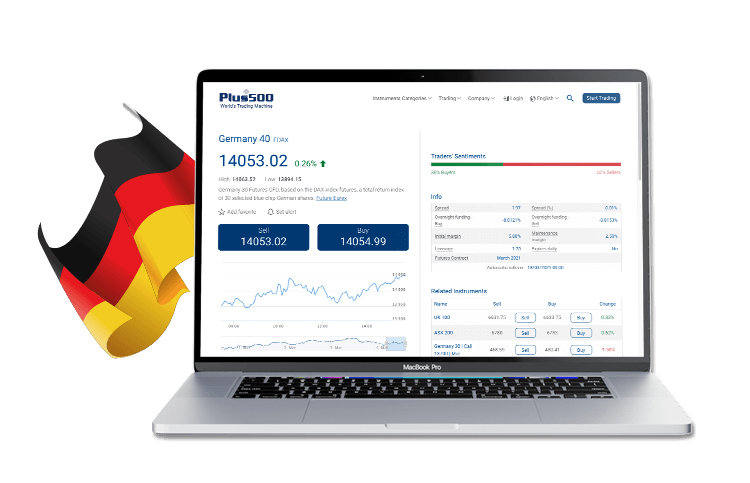

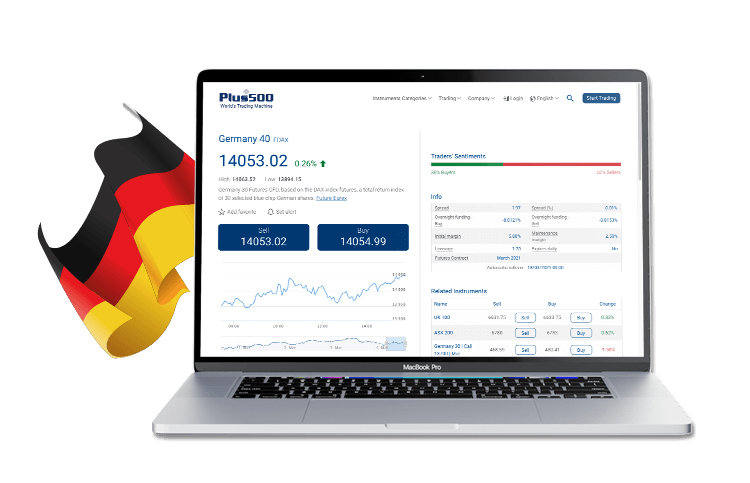

Illustrative prices.

TL;DR

- The DAX 40 tracks Germany’s 40 largest listed firms.

- Calculated via Xetra using market cap and trading volume.

- Prices move due to fiscal policy or monetary policy, investor sentiment, global trends, and company performance.

- Reviewed quarterly, firms can be added or removed.

What Determined the DAX 40 Value?

The value of the DAX is calculated by an electronic trading system called Xetra. This system weighs each company’s market capitalisation combined with its average trading volumes. This weighted figure serves as a snapshot that traders can use to track the index’s performance.

What Moves the DAX’s Price?

The principal factors driving the index's performance include geopolitical tensions and wars, fiscal and monetary policies, investor sentiment, the performance of its constituents, macroeconomic trends, and more.

Examples of DAX 40 Price Trends in 2025

Fiscal Policy and Government Expenditure

Germany’s sizeable fiscal initiatives, notably the €500 billion infrastructure fund and increased defence spending, have provided considerable upward momentum for the DAX 40. These measures underscore the government's commitment to fostering economic growth and have benefited sectors such as defence and infrastructure.

Monetary Policy

Expectations surrounding the European Central Bank’s (ECB) monetary stance, especially regarding policy easing and potential interest rate reductions, have had a material impact on equity markets. Lower borrowing costs enhance corporate profitability and support equity valuations, especially in capital-intensive industries.

Global Capital Flows and Investor Sentiment

A discernible shift in investment flows from U.S. equities to European markets has emerged, driven by valuation discrepancies, relative underperformance of American stocks, and a broader search for value. Additionally, the euro’s depreciation against the U.S. dollar has made German equities more appealing to international investors.

Performance of Major Constituents

Given the DAX 40's market-capitalisation weighting, the performance of its largest constituents, such as SAP, Siemens, Deutsche Telekom, and Allianz, has an outsized impact on the index. In recent years, a small number of these leading firms have been responsible for a significant proportion of the index’s gains.

Economic Indicators and Outlook

Macroeconomic data, including GDP growth, unemployment rates, inflation, and retail sales, directly affect market sentiment. Despite economic headwinds, improved labour market data and declining inflation have lent support to the index, even in the face of subdued retail activity and industrial weakness.

Geopolitical Developments and Trade Policy

Tensions in global trade, particularly between the United States and the European Union, and the imposition or threat of tariffs contribute to market volatility. The DAX 40 is acutely sensitive to such developments due to Germany’s export-oriented economy. Trade negotiations or retaliatory tariffs can directly influence corporate earnings and investor sentiment.

Sector Dynamics and Commodity Prices

Elevated energy prices and the ongoing transition towards renewable energy have exerted pressure on certain sectors. More recently, declines in oil and gas prices have offered some relief, providing a supportive tailwind for equities.

Market Technicals and Profit-Taking Activity

Following strong rallies, technical considerations such as profit-taking and short-term corrections can lead to temporary declines in the index, even when the broader trend remains positive.

Global Macroeconomic Trends

Broader themes such as fears of stagflation, slowing global growth, and monetary policies in other major economies, particularly the United States, continue to influence the DAX 40's performance.

How Do Companies Get onto the DAX Index?

The Frankfurt Stock Exchange board, which calculates the DAX, meets every quarter to review company standings and market valuations. A company can be removed if it falls out of the top 45 largest companies, or added once it breaks into the top 25.

The DAX’s movements are an overall snapshot of the day’s trading activity amongst all 40 companies. Its weighted valuation can rise even if the shares of some companies included on the DAX go down in price. Likewise, when some of the included companies see a rise in , the index as a whole can still fall.

What Are the Top DAX Companies?

DAX companies are chosen based on their free float-adjusted market capitalisation, representing the total value of their openly traded shares. The rankings are adjusted every quarter.

Conclusion

The DAX 40 serves as a vital barometer of Germany's economic health and investor confidence. Its value is driven by a complex mix of fiscal policy, central bank actions, global capital flows, and the performance of key listed companies. Understanding these factors helps investors navigate market trends and make informed decisions.

*Past performance does not reflect future results.

Illustrative prices.

What moves the DAX’s price?

The change in market value of each company included on the DAX index is weighted. This in turn determines what the index is worth on a daily basis.

For example, while SAP may have a larger market capitalisation than Linde, its impact on the index is capped at no more than 10% of the index totals. This way, the other 39 companies can still affect the listing’s valuation significantly, and ensures that a single company can have no more of an influence than what is warranted by the DAX’s overall values.

Once the market closes each day, the listed companies’ prices are calculated and placed into a determined formula, showing the top 40 companies’ overall daily movement. While the share price of some of the companies included on the index may have soared during that day’s trading sessions, others may have fallen. Traders can see if the index as a whole rose or fell based on the collective figure calculated at the end of the day.

This helps traders better evaluate the index’s movements and volatility over a period of days, weeks, months, or even years.

How do companies get onto the DAX index?

The Frankfurt Stock Exchange board, which calculates the DAX, meets to review company standings and market valuations every quarter. A company can be removed if it falls out of the top 45 largest companies, or it can be added once it breaks into the top 25.

The DAX’s movements are an overall snapshot of the day’s trading activity amongst all 40 companies. Its weighted valuation can rise even if the shares of some companies included on the DAX go down in price. Likewise, when some of the included companies see a rise in share prices, the index as a whole can still fall.

*Largest companies as of October 2021.

FAQs

The DAX 40 is a stock market index tracking the 40 largest companies on the Frankfurt Stock Exchange, reflecting Germany’s economic and market performance.

The DAX is calculated via Xetra, an electronic trading system that weights companies using free float-adjusted market capitalisation and trading volume.

Key drivers include fiscal and monetary policy, global investment flows, corporate performance, geopolitical risks, and macroeconomic indicators.

To be added, companies must rank among the top 25 by free float market cap. They may be removed if they fall below the top 45. Reviews occur quarterly.

Top firms include SAP, Siemens, Deutsche Telekom, and Allianz, ranked by their free float-adjusted market capitalisation.

Learn More About Germany 40

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.