How to Trade ASML Holding: ASML Stock Price Trading Guide

Date Modified: 12/10/2025

ASML (ASML.AS) may be a strong candidate for the next addition to your CFD share trading portfolio, with strong market fundamentals and its position in a growing industry. This article will take you through the history of this prominent semiconductor firm, evaluate the factors impacting its stock performance, and discuss how CFD trading can potentially allow you to capture its price movements. However, it's important to be mindful of the inherent risks involved in this type of trading.

TL;DR

- ASML Holding N.V. is a leading Dutch multinational company in the semiconductor industry. It specialises in advanced lithography machines crucial for chip production.

- ASML's stock has experienced significant growth since its IPO, particularly due to its exclusive EUV technology, despite fluctuations in market volatility over the years.

- Trading ASML shares can be done traditionally on stock indices or via CFDs, with the latter offering flexibility but higher risks due to leverage.

- Investors should thoroughly analyse market factors and employ robust risk management strategies when trading ASML shares, especially in the volatile CFD arena.

What Is ASML Holding?

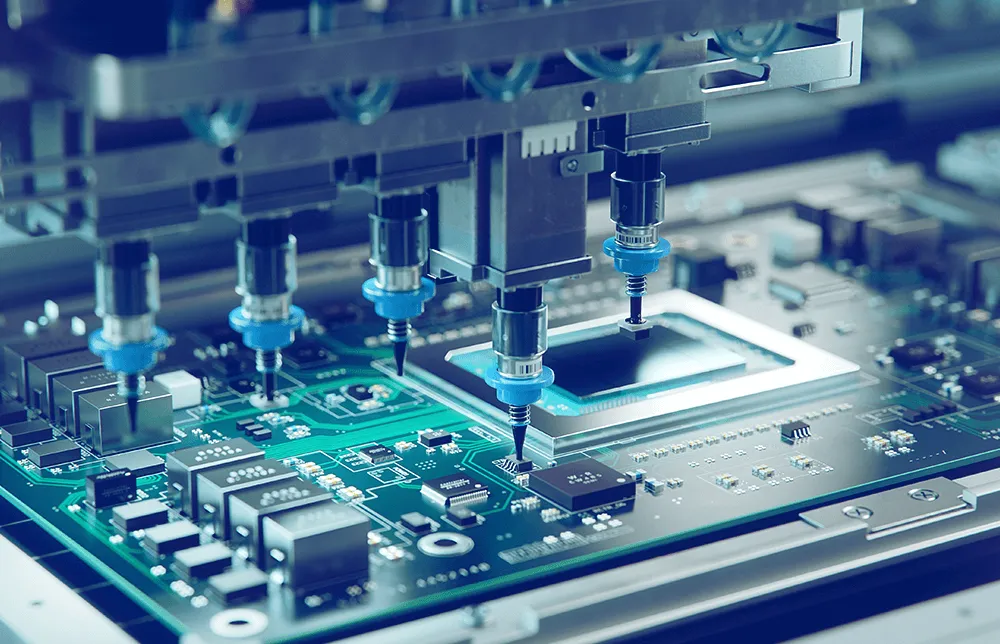

ASML Holding N.V., established in 1984, is a Dutch multinational company specialising in the machines crucial for semiconductor manufacturing. As of 2023, ASML was the world’s largest supplier of the semiconductor industry and the sole provider of extreme ultraviolet (EUV) lithography machines, which make the intricate designs on silicon wafers essential for producing advanced computer chips. By March 2024, the company’s market capitalisation reached approximately $397 billion, making it Europe’s most valuable tech firm. ASML is publicly traded on the AEX and NASDAQ (US-TECH 100). ASML continues to lead in innovation with its cutting-edge EUV systems and ongoing developments in the next generation of lithography technology.

ASML Stock Price History

ASML's stock price has evolved dramatically since its initial public offering. The firm reached its all-time high stock closing price of over $1,008 on July 12, 2024. This peak reflects the strong demand for ASML's cutting-edge photolithography machines, particularly its exclusive extreme ultraviolet (EUV) systems, essential for advanced chip manufacturing.

However, it took many years for ASML's share price to reach its 2024 peak. Over the past few decades, ASML's stock journey mirrors the broader tech industry's ebbs and flows. In the early 2000s, the company's stock was volatile, impacted by the burst of the dot-com bubble. For example, in 2002, the stock plunged by nearly 51%, reflecting the broader downturn. However, ASML proved resilient, rebounding strongly in subsequent years as the semiconductor demand surged.

The 2010s marked a period of significant growth for ASML. The company's stock price surged, driven by its leadership in EUV technology and the increasing global reliance on semiconductor chips. In 2019, ASML's stock price nearly doubled, ending the year at $282.01, showcasing the company's critical role in the tech ecosystem.

The COVID-19 pandemic in 2020 brought challenges, but ASML emerged stronger. Its stock price climbed sharply in 2021, reflecting a 64.12% annual increase. This period underscored ASML's importance as the world turned to digital solutions during lockdowns, spurring chip demand.

As of 2024, despite some fluctuations, ASML's stock remained robust, rising 40% in value over the first half of the year. This trend may highlight investor confidence in ASML's continued innovation and market dominance despite macroeconomic headwinds.

What Are ASML Shares?

ASML's share capital consists of common shares traded on the NASDAQ since its IPO. A crucial distinction for CFD traders to understand is the difference between traditional ASML shares and ASML share CFDs.

Traditional ASML shares are listed on the NASDAQ. When you purchase these shares, you buy a stake in the company's equity, giving you ownership rights and a claim to a portion of ASML’s assets and profits. Shareholders may receive dividends and have voting rights in corporate decisions during annual general meetings. The value of these shares fluctuates based on the company’s performance, market conditions, and broader economic factors.

Conversely, ASML share CFDs are financial instruments that allow investors to trade on the price movements of ASML shares without owning the underlying assets. With CFDs, investors can take long positions (anticipating that the share price will rise) or short positions (anticipating that the share price will fall). A key characteristic of trading CFDs is their leverage, enabling investors to gain more significant exposure to ASML shares with a smaller amount of initial capital. However, this leverage also significantly increases potential losses. Unlike traditional shareholders, CFD traders do not possess rights and responsibilities like voting as they do not own the actual share.

Factors Affecting ASML Stock Price

Like many international concerns, ASML’s share price is subject to ups and downs stemming from various factors. Understanding these is crucial for the CFD trader, as shifts in ASML’s share value affect the overlying CFD’s price dynamics.

- Market Position: ASML is dominant in the semiconductor equipment industry, particularly due to its exclusive production of advanced EUV lithography machines. These machines are essential for producing high-quality microchips, making ASML's technology crucial for leading semiconductor companies. This technological edge has driven significant revenue growth in the past, positioning ASML ahead of competitors like Nikon (7731.TY).

- Cost Challenges: The advanced technology of ASML’s equipment comes with substantial costs. The high price of EUV machines, coupled with increasing production complexities, presents challenges. As semiconductor development becomes more intricate, costs for design, human labour, and R&D continue to rise. These escalating costs could limit the customer base and impact profitability, especially during economic downturns when companies may be less willing to invest.

- Global Markets: The expanding global semiconductor market, driven by trends like AI and electric vehicles, offers growth opportunities for ASML. With key markets in Taiwan, South Korea, and China, ASML is well-positioned to capitalise on increasing demand. However, geopolitical risks, such as export bans on semiconductor technology to China, pose significant threats. These bans could not only reduce ASML’s sales but also foster competition as Chinese companies develop rival technologies.

- Overall Economic Changes: Changes in the global economy’s health and accompanying policy shifts, such as inflation, interest rate policies, and GDP growth, may impact ASML’s bottom line.

ASML Trading Hours

Traditional shares of ASML are traded on the NASDAQ exchange. The trading hours for ASML shares on NASDAQ are from 9:30 AM to 4:00 PM Eastern Standard Time (EST).

In contrast, trading ASML shares CFDs on the Plus500 trading platform is typically available on weekdays from 07:00 AM UTC to 15:30 PM UTC.

Please note that trading hours may vary depending on the specific CFD trading platform or broker.

How to Analyse ASML Share Price

Understanding ASML's share price fluctuations requires a multifaceted approach incorporating technical, fundamental, and sentiment analysis. Each method offers distinct insights into market trends and investor behaviour.

Technical Analysis

- Chart Patterns: You can examine ASML's price charts for consistent patterns, such as trendlines, support and resistance levels, and specific formations, to predict potential price movements.

- Technical Indicators: You can utilise tools like the Relative Strength Index (RSI), Moving Averages, and the Stochastic Oscillator to assess momentum, trend direction, and whether ASML shares are overbought or oversold.

Fundamental Analysis

- Economic Environment: You can analyse the broader economic context, including sector performance, macroeconomic indicators, and regulatory developments, to understand how these factors impact ASML.

- Financial Performance: You can review ASML's financial statements, including balance sheets, income statements, and cash flow reports released during earnings season, to evaluate the company's financial stability and growth prospects.

- Sectoral Competition: Compare ASML's market position to that of its competitors, focusing on market share, product offerings, and technological advancements to determine its competitive edge in the semiconductor industry.

Sentiment Analysis

- Market Sentiment: Monitor overall market trends and their potential impact on ASML shares to forecast changes in investor sentiment.

- Financial News: Follow media coverage, analyst opinions, and industry reports related to ASML to understand how these factors shape market perception and investor attitudes.

Different Ways to Trade ASML Shares

Trading ASML shares can be approached in at least two ways: traditional stock trading and trading Contracts for Difference (CFDs). Each method offers distinct opportunities and risks, catering to different types of investors.

Traditional stock trading involves buying and selling ASML shares directly on the NASDAQ. When you purchase ASML shares, you own a piece of the company, which may provide dividends and the potential for capital appreciation. This approach is generally suited for long-term investors looking to benefit from the company's growth over time. The process is relatively straightforward: buy shares at a certain price, hold them, and then sell when the price increases to realise a profit.

In contrast, trading ASML share CFDs on platforms like Plus500 allows investors to speculate on the price movements of ASML shares without owning the underlying stock. CFDs are financial instruments that reflect the underlying shares' price movements. This type of trading is flexible, as traders can take both long and short positions, thus capturing the rises and/or falls of ASML’s share price. CFDs also involve leverage, meaning traders can control larger positions with a relatively small amount of capital. While this can significantly amplify potential profits, it also increases the risk of substantial losses, especially if the market moves against the trader.

The inherent risks of CFD trading are notable. Market volatility and rapid price fluctuations can lead to quick losses, sometimes exceeding the initial investment due to the leveraged nature of CFDs. This makes CFD trading much riskier compared to traditional stock trading. To mitigate the risks associated with this high-risk form of trading, traders must have a solid risk management strategy in place, including setting stop-loss orders and carefully managing leverage.

How to Trade CFD ASML Shares with Plus500 (Step-by-Step)

- Build Your Knowledge: Utilise resources such as Plus500’s Beginners Guide and Trading Academy to deepen your understanding of CFD trading with ASML shares, focusing on the mechanics, strategies, and associated risks.

- Registration, Verification, Deposit: Register for a Plus500 account, complete the required verification process, and make your initial deposit to begin trading.

- Start Trading: Access the Plus500 platform and begin your journey in CFD trading by analysing the current state of the market and determining your outlook on ASML shares.

- Open and Monitor Positions: Based on your market analysis, decide whether to take a buy or sell position on ASML shares. Regularly monitor the market and your open positions to stay informed of any developments, and review your trading strategy to make adjustments as needed.

Conclusion

In summary, ASML Holding N.V. is the semiconductor industry's cornerstone, driving technological advancements through its innovative EUV lithography machines. Whether trading traditional ASML shares or engaging in CFD trading, investors must carefully consider the associated risks and market dynamics to make informed decisions in this rapidly evolving sector.

FAQs

ASML is listed on both the NASDAQ and Euronext Amsterdam exchanges.

ASML's biggest competitors include Canon (7751.TY), Nikon, TSMC, and Ultratech, among others.

As of 2024, Taiwan Semiconductor Manufacturing Company (TSMC) is ASML’s biggest customer.

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.