Bitcoin Halving: All You Need to Know

Date Modified: 26/10/2025

Given Bitcoin's status as one of the most important and leading Cryptocurrencies, traders and market watchers may want to keep track of any events that could shift Bitcoin's price and cause potential volatility in the markets in general, and the Cryptocurrency market, in particular. One of the most anticipated and influential events that should probably be kept in mind is the Bitcoin Halving.

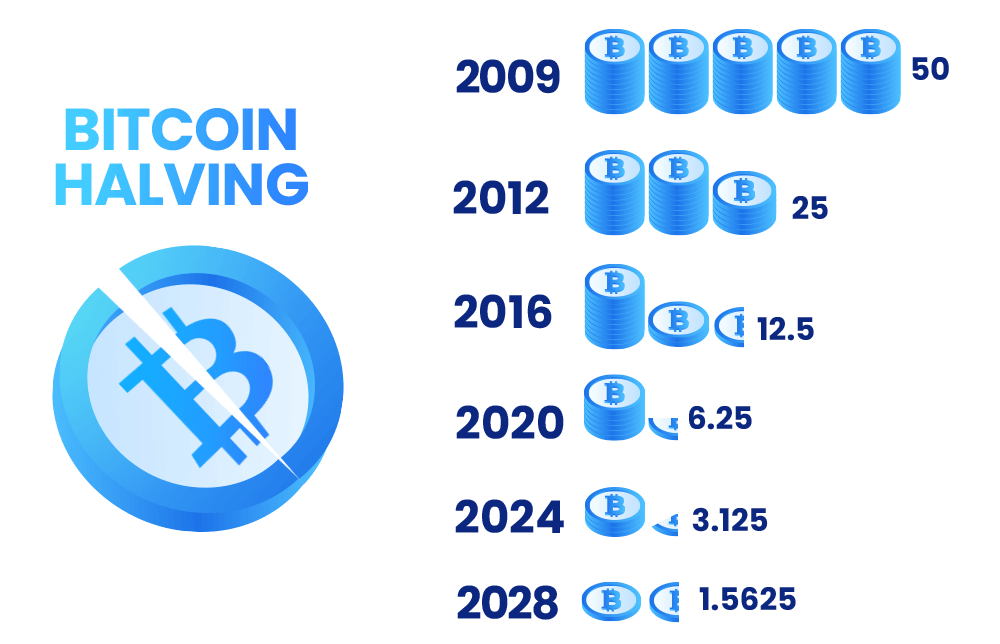

Since its creation in 2009, there have been 4 Halvings (or Halvenings) that impacted the price of Bitcoin. The last Bitcoin Halving took place on April 19, 2024 while the next Bitcoin Halving is expected to take place in March 2028.

These Halving events not only affect the price of Bitcoin and other Cryptocurrencies but also have a direct impact on Bitcoin miners. Here's what you need to know about the Bitcoin Halving, how the last Halving shifted the markets, and what it meant for miners:

TL;DR

- Bitcoin Halvings are when Bitcoin production is cut in half.

- As of 2024, Bitcoin has been halved 4 times.

- The last Bitcoin Halving took place on April 19, 2024, and the next one is expected to take place in March 2028.

- Bitcoin Halvings can affect the markets, Bitcoin prices and production, and the income of miners.

- Following the latest Halving on April 19, 2024, miners' rewards dropped to 3.125 (from the previous 6.25).

Understanding the Bitcoin Network: Bitcoin Mining Explained

To understand the definition of Bitcoin Halving, it is important to know how the Bitcoin network operates. Bitcoin operates through a decentralised system known as blockchain, which validates and records transactions. This enables individuals to exchange digital currency (Bitcoins) directly, eliminating the requirement for a central entity (like it would be needed in fiat money/cash transactions).

In addition, Bitcoins are mined, which means that people (miners) use computers to solve difficult math problems to validate Bitcoin transactions and increase network security. When a problem is solved, the miners who solve it earn new Bitcoins as a prize, and new Bitcoins are generated. As such, when Halving events happen, Bitcoin mining is directly affected. To understand how Bitcoin functions better, read our article on How Bitcoin Works.

What Is the Bitcoin Halving and How Does It Work?

In simple terms, Bitcoin (BTC) Halving refers to the event that happens every 4 years whereby mining new coins is affected and new Bitcoin production is cut in half.

In other words, when a Halving event occurs, miners receive 50% less Bitcoin, for the same amount of effort. The purpose of a Halving event is supply and demand: With less supply, there is greater demand, and thus the value of each Bitcoin is generally expected to increase.

Why Does Bitcoin Halving Occur?

A Bitcoin Halving event can take place in order to mainly ensure the following factors:

- Inflation Control: Bitcoin is halved to curb the potential inflation within the Bitcoin system. This is because when the production of new Bitcoins is reduced and block rewards are decreased, Bitcoin's long-term price stability and value are more likely to be retained which helps control price inflation.

- Scarcity and Controlled Supply: Bitcoin was created with the intent of being a rare and limited Cryptocurrency. As such, when Bitcoins are halved, their availability becomes rarer, which can then affect their value and supply.

How Does Bitcoin Halving Affect Bitcoin Trading?

At face value, a Halving might sound like a negative event for Bitcoin miners; however, for traders and investors, it can come with many positives depending on their goals and positions. While past results cannot indicate future performance, interestingly, in the past Halvings Bitcoin's price surged and strengthened against the US dollar. Accordingly, for some Bitcoin investors and traders, the Halvings' effects may have come as welcome news then.

Here are more factors Bitcoin Halvings can influence:

- Bitcoin Prices: Halving directly affects Bitcoin prices both in the short and long run. Past Halvings have resulted in an increase in Bitcoin price volatility, hence causing Bitcoin prices to shift. In addition, many market participants refer to Halvings as a potential gauge for Bitcoin prices in the future, hence affecting the price outlook.

- Market Sentiment: Due to the fact that Bitcoin Halvings can pique many market participants' interest, it can also affect market sentiment (how the market approaches Bitcoin), which in turn affects trading activity.

Bitcoin Halving Dates: When Did the Previous Bitcoin Halvings Happen?

As mentioned above, since 2009, there have been 4 Bitcoin Halving events. The first time a Bitcoin Halving occurred was on November 28th, 2012. By that year, about 10,500,000 Bitcoin had been mined, each valued at approximately $11 a coin. Within the next year, this value would rise a hundredfold. The next Bitcoin Halving took place on July 9th, 2016, followed by the third Halving on May 11, 2020. Finally, the last Halving took place on April 19, 2024. As for when the next Bitcoin Halving event might take place, many posit that it is expected to occur in April 2028.

Here's an infographic of what happened the last time Bitcoin was halved:

Does Bitcoin Halving Have an Impact on the Price of BTC?

In the aftermath of past Halvings, the price of Bitcoin against the US dollar has appreciated. For instance, after the Halving event of 2012, the price of BTC/USD skyrocketed from around $11 to over $1000 in a single year - an increase of 80 times. After the Halving of 2016, the price of Bitcoin increased again; BTC remained in the $580-700 price range for a couple of months before slowly gaining towards the end of the year to the $900 level.

It may be interesting to note that following the Halving of May 11, 2020, Bitcoin's price did not rise immediately as factors like the Coronavirus actually caused it to depreciate. Nonetheless, in July 2020, Bitcoin rose to over $12,000.

However, it is important to note that the demand for Bitcoin can drastically fluctuate and that the circumstances around each Halving are very different. This means that it is not at all easy to attribute a bullish or bearish price movement to a specific Halving event.

Bitcoin's Four-Year Cycle: How Often Does the Bitcoin Split Occur?

Bitcoin Halvings are scheduled to happen every time 210,000 blocks are mined, which occurs approximately once every four years.

The Pros and Cons of Bitcoin Halving

As the price of Bitcoin tends to increase after each Halving, Bitcoin owners generally feel the positive effects; the value of their holdings generally increases.

Halving events tend to be a good thing for the demand for Bitcoin, as supply drops - this can be considered a catalyst for positive price action for the future of Bitcoin and the other altcoins.

However, traders must keep in mind that there may be some negative after-effects of the Bitcoin Halving. Some analysts have predicted that other altcoins may suffer as a result of the Halving; after Bitcoin's bull run in 2019, a lot of the smaller altcoins suffered when their investors turned to Bitcoin.

There is also the risk that Bitcoin could suffer a big crash if the miners sell off their rewards because of the sudden doubled cost they'll incur to mine.

Volatility also tends to occur as a result of a Halving, which can be a pro or a con - generally volatility increases before and after the event. Traders can use volatility to their advantage of course; however, wild price fluctuations also can make it difficult to ascertain a pattern in pricing, which therefore makes it harder to implement a successful trading strategy.

Bitcoin Halving 2024: What Happened After the Last Bitcoin Halving?

Previous Halving events led to an upswing in the price of Bitcoin. The first Halving saw BTC's price jump from $11 to $1,100, the second Halving led to the value of Bitcoin increasing from $600 to $20,000 in 18 months, while the third led to Bitcoin rising from $9,000 to around $30,000. Half an hour following the fourth Halving on April 19, 2024, Bitcoin's price neared $63,000 and hit over $65,000 the following day.

However, the circumstances surrounding each Halving may be different and demand for Bitcoin can fluctuate wildly, particularly in light of the coronavirus pandemic, the war in Ukraine, as well as inflation, all of which have proven to be an economic test for even the most "stable" of assets.

Bitcoin's Next Halving

The next Bitcoin halving, a pivotal event in the cryptocurrency's protocol, is anticipated on 26 March 2028. This event, expected to take place just under four years after the previous halving, will reduce the block reward from 3.125 BTC to 1.5625 BTC.

The halving plays a crucial role in controlling Bitcoin's supply, as it decreases the rate at which new Bitcoins enter circulation, reinforcing its scarcity and deflationary nature. Historically, such events have influenced Bitcoin's price, often contributing to long-term appreciation due to supply and demand dynamics.

For miners, the halving represents both a challenge and an adjustment period. As rewards diminish, profitability may be impacted, requiring more efficient operations or higher Bitcoin prices to maintain incentives.

The broader cryptocurrency market typically experiences heightened interest and speculation leading up to halving events, which can result in significant price volatility. However, while historical patterns indicate potential price increases post-halving, market reactions depend on a multitude of factors, including sentiment, external influences, and demand.

Furthermore, although Bitcoin has continuously increased in value since its 2009 inception, it cannot be predicted with any certainty whether the aforementioned halving will occur when expected, or how this digital currency's price dynamics will shift in its wake. Investors will have to wait and see how other events going forward may affect its price.

How to Trade the Bitcoin Halving

Bitcoin is expensive to buy. If you BUY Bitcoin and the price crashes, you will be stuck with an expensive loss. An alternative to buying Bitcoin would be trading CFDs on Bitcoin, which means you can speculate on the price movement, rather than buying the asset outright. You can also wait for the Halving event to occur and then open either BUY or SELL positions in BTC/USD, depending on which way you believe the pair is moving. Additionally, with CFDs, you can trade in both rising or falling markets. If you believe the price of Bitcoin will drop then you can open a SELL position. Alternatively, if you believe the price will be moving up, then you can BUY low and SELL high. Learn more about CFD trading in our What Is CFD Trading article and video.

How Do I Manage the Risks of Trading Bitcoin?

There are various measures you can employ to manage your risk while trading Bitcoin, including limiting the capital you put into each trade. That can be 10%, 5% or less depending on your trading strategy.

You can also use risk management tools like the Stop Loss and Take Profit orders that you will find on the Plus500 platform. Stop Loss stops out your trades when the value of the asset falls to, or past, a certain level. Take Profit allows you to close a position when it has accrued a certain level of profit in order to lock in the profits. There is also the Guaranteed Stop order, for which a fee is charged but it guarantees that your position will close at the exact rate you specify.

Illustrative prices.

How will Bitcoin Halving Impact the Crypto Markets?

In terms of the Crypto market as a whole, Bitcoin tends to be the flag bearer for the wider market. Most of the leading Cryptocurrencies seem to rise when Bitcoin rises for a reasonable time, concluding that altcoins, like Ethereum and Litecoin, and Bitcoin bull periods may be positively correlated. The aphorism "A rising tide lifts all boats" certainly seems to be the case with the altcoins, which have been trading in a bullish trend after each past Halving. While the global economy is in chaos, and almost all assets are suffering as a result, Bitcoin owners may potentially once again reap the rewards of the next Halving. Watch this space and remember you can trade Bitcoin CFDs with Plus500.

Conclusions and Takeaways

In conclusion, the next Bitcoin Halving which is expected to happen in April 2028 can be a volatility-inducing event that can shift the overall markets, in general, and the Crypto sector, in particular. Nonetheless, the extent of this event's effects is yet to be seen.

*Subject to operator availability

Trade Bitcoin (BTCUSD) CFDs with Plus500 today.

Other Helpful Resources on Bitcoin:

- What Moves Bitcoin's Price - Article

- What Is Cryptocurrency Trading - Article

- What Are the Most Traded Cryptocurrencies - Article

- How to Trade Cryptocurrencies with Plus500 - Video and article

- What Are Bitcoin ETFs & How to Trade Them - Article

FAQs

The next Bitcoin Halving is expected to occur in March 2028.

It is believed that the last Bitcoin to be mined will be in the year 2140.

A day after the last Bitcoin Halving on April 19, 2024, Bitcoin prices hit over $65,000 up from the $63,000 the previous day.

Overall, a total of 32 Bitcoin Halvings is set to happen, which leaves 28 more Halvings to come.

Related News & Market Insights

Get more from Plus500

Expand your knowledge

Learn insights through informative videos, webinars, articles, and guides with our comprehensive Trading Academy.

Explore our +Insights

Discover what’s trending in and outside of Plus500.

Stay up-to-date

Never miss a beat with the latest News & Markets Insights on major market events.