What Are Indices?

If you ever wondered if market trends and traders sentiment can be tracked, then this article is for you. Traders can attempt to assess such factors through the use of stock market Indices.

Accordingly, in this article, we are going to examine market Indices, how they are calculated, and the benefits of using them when trading.

What Is a Stock Market Index?

Indices are highly popular among traders. They first emerged in 1884, and have been in use ever since. Market Indices are a collection of stocks and instruments used to track the growth or trajectory of an industry or sector. These whole-sector tools allow us to look at how a chunk of the market is performing to better understand investment opportunities along with market fluctuations. For example, the Nasdaq Composite Index mainly tracks the trajectory of technology companies, so traders often refer to it when assessing the performance of the technology sector. Other examples of renowned stock market Indices include, but are not limited to, the S&P 500 (USA), DAX 40 (Germany) and FTSE 100 (UK) all of which are a collective of each country’s largest companies based on their market capitalization. Moreover, since an index tracks a basket of publicly traded stocks, by following the index, traders can understand the broad movements and events of the market and plan out their investment strategies accordingly.

How are stock market indices calculated?

There are many factors that go into the calculation and the structure of a stock index and, to better understand how indices are calculated, it is important to understand how they are constructed.

Each exchange requires their listed companies to maintain a high standard of accounting and public reporting. Companies such as Standard & Poors (S&P), Xetra, Financial Times Stock Exchange Group (FTSE), and others review these published reports to audit the health and growth of publicly traded companies.

Once compiled, these companies publish their findings, which global investors have relied on for decades. The S&P 500, Xetra’s DAX 40, and the FTSE 100 have reliably guided investors through both prosperous and challenging times, providing honest insight into some of the world’s largest companies.

Take for example the FTSE 100, which consists of 100 companies with the biggest market cap on the London Stock Exchange, and is measured by weighing the market cap of all these companies’ stocks. Therefore, companies with a bigger market cap make a bigger effect on the index’s weight and vice versa.

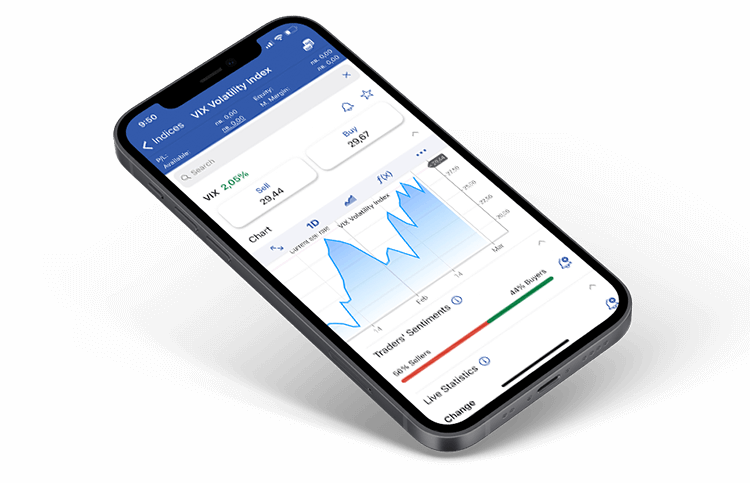

Illustrative prices.

Can I profit from index trading?

Indices rise and fall on a daily basis. Calculated by grouping together similar companies, traders use these tools as whole market or sector indicators to better understand market movements.

Trading CFDs on indices means that you can potentially benefit from upward and downward movements depending on your position.

For example, after an announcement by Netflix, you predict that it will have a positive effect on the tech industry as a whole. You can open a Buy position on Plus500’s US-Tech 100, hoping to profit on this index’s movement. If the index does indeed rise, you can close your position and profit from the difference between your purchase price and closing price. On the other hand, if the index falls and you close your position, you will incur a loss.

If you predict that there will be a negative effect on the index, you can open a Sell position. If the price does indeed drop, you can close your position and make a profit from the difference. If the value of the index rises and you close your position, you will incur a loss.

Benefits of Index Trading

Stock indices’ popularity stems from their multifaceted and purposeful nature. Listed below, are a few examples of the benefits of stock index CFDs:

- Lower initial margin with higher leverage: trading CFDs on Indices means that you get access to multiple sector-specific or country-specific Indices with lower margin requirements than if you actually decide to trade an individual index.

- Trading CFDs on Indices means that you can benefit from upward and downward movements depending on your position.

- More exposure to the market: instead of buying individual stocks, you get to speculate on the price of multiple stocks for lower prices, thus diversifying your portfolio and getting more exposure to market assets.

- Easier access hedging on your own portfolio:: trading CFDs on Indices allows you to hedge against any devaluation in your existing portfolio. Doing so while trading traditionally, through purchasing an individual index, is not as straightforward and cost-efficient, as it is through CFDs.

- Trading on Indices can be an effective way to diversify trader risk, as it provides wider exposure when compared to trading on an individual stock by providing a larger picture of the market’s performance. When trading on a stock, fluctuations in the stock price are based on a large number of factors such as performance, revenue, and confidence in their ability to produce exciting products.

On the other hand, one must be mindful of the fact that Indices may be computed differently. For instance, some Indices are price-weighted while others are market-cap-weighted which means that you get different or unbalanced valuations for some companies that are included in different Indices. Moreover, trading CFDs using leverage can largely amplify your profits but it can also amplify your losses.