Why Trade Cryptocurrency CFDs?

There has been a surge of interest in cryptocurrencies over the past few years. That demand has led to many CFD trading platforms and brokers now offering cryptocurrency trading pairs. These trading pairs can include one cryptocurrency, for example, Bitcoin, and one fiat currency, such as the US dollar. Here the trader makes a profit, or loss, by forecasting whether the cryptocurrency side of the pair will gain or lose value against the fiat currency.

The other kind of cryptocurrency pair is made up of two different cryptocurrencies, for example, Bitcoin and Ethereum. In this case, the trader makes a profit, or loss, by forecasting whether the leading cryptocurrency of the pair will gain or lose value against its cryptocurrency partner.

In that respect, trading cryptocurrency CFD pairs work in the same way as trading CFDs on forex pairs. In a more general sense, trading cryptocurrency CFDs is executed in the same way as trading CFDs on other, more traditional asset classes like commodities, stocks or stock market indices in that a trader speculates on the price movements of their chosen instrument.

So, why would a CFD trader choose to trade specifically on cryptocurrencies, rather than traditional assets? Let’s take a look at some of the most common reasons for trading cryptocurrency CFDs.

Cryptocurrencies As a New and ‘Disruptive’ Technology

Cryptocurrencies have been around since Bitcoin, the original cryptocurrency, launched in 2009. However, only in the last few years they have developed from something with a limited, niche following of mainly tech enthusiasts into a new asset class that promises to carve out a long term and important role in mainstream financial markets.

Cryptocurrencies are seen as a ‘disruptor’ which means they have the potential to fundamentally change how the financial market works. In 2022, for example, there are currently over 1800 altcoins in the market. The substantial growth in the number of cryptocurrencies since 2013, when there were only about 66 cryptocurrencies in existence, is not only a distinct example of how cryptocurrencies have shifted the market, but it might also mean that they have the capability to shape it in the future as well.

When disruptive technologies succeed in fundamentally changing markets and also have a financial asset form, they are generally the assets that show the biggest gains in value over time. Ten years ago, Amazon’s stock was worth around $83; today the same stock trades for over $3,000. This is a huge profit for early investors and one that almost only happens with disruptive technologies.

Some traders believe the ‘disruptive’ new technology of cryptocurrencies will fundamentally change money and commodity markets in the upcoming years; they are hoping for the kind of huge returns that early investors in promising tech stocks are hunting.1

Likewise the price of cryptocurrencies like Ethereum, for example, has also skyrocketed since its launch as it was priced at only $0.31, and by November 2021 it hit a record-high of $4,880.

Cryptocurrencies as a Commodity

There is an argument that some cryptocurrencies are more like commodities. An example of this would be the cryptocurrency Ethereum, which is not intended to be used as an alternative to money but instead pay for the use of its blockchain platform. The purpose of its blockchain platform is to build smart contracts. The price of commodities is influenced by global demand: for example, oil is used in fuels, plastics, and other materials so its price is influenced by global demand for products made from oil. The price of ‘utility’ cryptocurrencies, like Ethereum and, and, Chainlink, is influenced by the use of the blockchain platform they are associated with.

Cryptocurrencies Are Much More Volatile Than Traditional Assets

Cryptocurrency traders often make their profits or sustain losses on shorter-term positions, rather than when they hold them over a period of 5, 10 or 20 years. They open and close positions to take advantage of price movements over weeks, days, hours or even minutes.2 Trading traditional asset classes over shorter time periods usually involves much smaller price changes than what would be seen over a period of months to years, but with cryptocurrencies being as volatile as they are it is not unusual to see massive price fluctuations in a much shorter period of time.

For most traditional assets it is very rare to see a 1% price movement in a single day. These movements usually only happen when something significant is happening in the market that dramatically changes investor sentiment. On the other hand, in the cryptocurrency market, it is relatively normal for individual cryptocurrencies to see their prices change by a few percentage points per day. When something significant happens in the cryptocurrency market, the price movements can be as much as 10% or more. This can potentially give traders many more regular opportunities to make significant profits from short term trades. Of course, this also makes trading cryptocurrencies riskier than less volatile assets, so traders have to be careful as significant losses can also be incurred.

Cryptocurrency volatility is another sign of their novelty as an asset class. As the market matures, it could be assumed that volatility will gradually drop to a level that would be expected of more traditional asset classes.

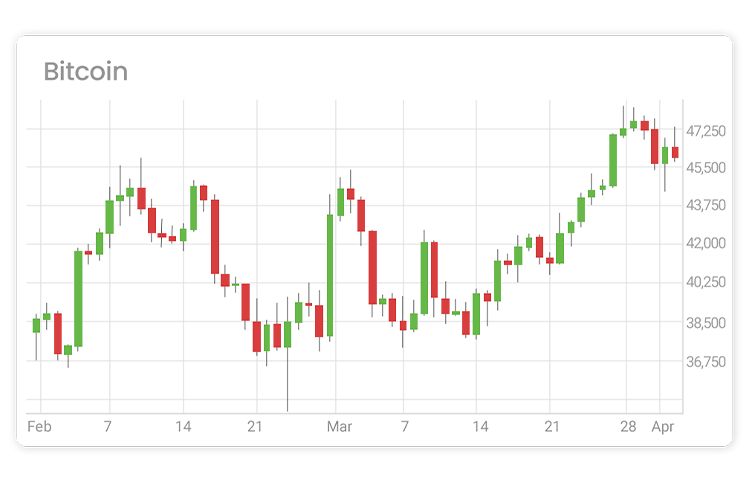

Illustrative prices.

The chart above shows how the value of Bitcoin has increased from around $38,784 in early February 2022 to $46,445 in April 2022. That’s an increase of around 20%.

The chart below shows the price movement of Oil which had a particularly volatile few months in 2022 especially due to the war between Russia and Ukraine, and resulting Western sanctions on Russian energy led to an ostensible hike in its prices. As it neared its 14-year high in the middle of March, Oil reached almost $124 per barrel before dropping to $99 per barrel at the beginning of April.

Illustrative prices.

The difference is huge. And it’s those big, regular price swings that make trading cryptocurrencies so attractive to traders who wish to take advantage of the volatility.2

Using Leverage to Trade Cryptos

When trading CFDs, leverage is used to multiply exposure. For instance, if a chosen cryptocurrency CFD has a leverage ratio of 1:2 and the price moves 5%, the CFD trader will actually make a profit of 10% (or a loss of 10% depending on the direction of the price movement and the type of position the trader has selected). This means that CFD traders can make or lose significant amounts of money quickly.

Trading Cryptocurrencies As CFDs Means Platform Security

When trading cryptocurrency CFDs, you don’t actually own the cryptocurrencies: rather, the trader speculates on their price movement. This means you are able to trade on the cryptocurrency market without the risk of a hacker breaking into your cryptocurrency wallet and taking your money. In addition, most trading platforms are SSL secured ensuring a safe environment for transactions.

Taking Short Positions When Trading Cryptocurrencies

When trading cryptocurrency CFDs it’s also possible to speculate on the falling prices of an asset, rather than relying on the value to increase. For example, a Sell position on a cryptocurrency CFD will profit when the buy rate of the cryptocurrency falls below its opening Sell rate, but will be in loss if the Buy rate rises above the opening sell rate.

Trading Cryptocurrencies With Plus500

Traders who believe they would be able to trade cryptocurrency CFDs are able to do so on the Plus500 trading platform. A strong selection of individual cryptocurrencies to USD, crypto to crypto cross pairs and even the popular Crypto 10 index are all available to trade as CFDs on their intuitive platform. After successfully opening a trading account, you can select the crypto CFD instruments you would most like to trade and get started.

Traders who choose to trade cryptocurrency CFDs with Plus500, get to enjoy trading with a regulated provider that has a safe and intuitive platform with trustworthy risk-management tools. Furthermore, they get to enjoy generous leverage and many educational articles and how-to-videos to help them get the best out of their trading experience.

1 Past performance is not a reliable indicator of future results.

2 Please check your platform’s scalping policy.

*Instrument offering is subject to operator.